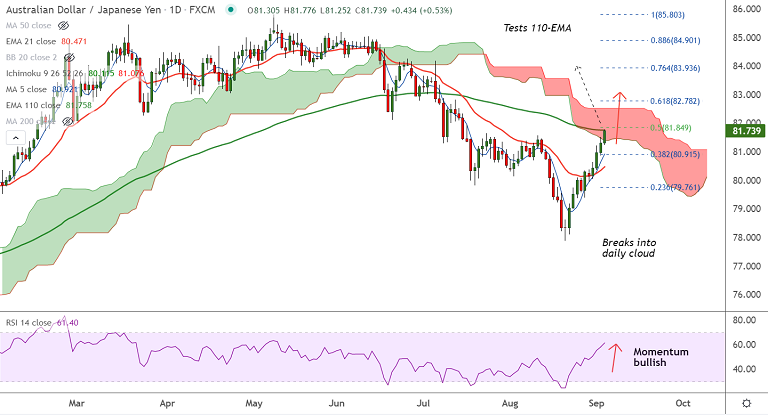

AUD/JPY chart - Trading View

AUD/JPY was trading 0.51% higher on the day at 81.71 at around 09:15 GMT, hits 7-week highs.

Yen remains on the backfoot amid Japan’s political jitters after news of the Japanese Prime Minister's step down to tackle coronavirus infections.

On the other side, Aussie gains after the news confirmed that the Australian Prime Minister Scott Morrison confirmed to get 4m doses of Pfizer vaccine from the UK.

Australian dollar largely ignores downbeat Retail sales data, which declined 2.7% in July, from -1.8% in June.

The pair is extending gains for the 2nd straight week. Price action has bounced off weekly cloud and 200-week MA support.

Decisive break above 50-DMA has raised scope for further upside. The pair is testing 110-EMA resistance at 81.75.

Momentum indicators are strongly bullish. RSI is well above the 50 mark. MACD and ADX support gains.

Scope for test of 200-DMA at 81.96. Rejection at 110-EMA and retrace below 21-EMA will negate any upside bias.