- AUD/JPY perceived as a risk barometer remains heavily offered amid a fresh bout of risk aversion.

- The pair is extending downside after a massive slump on Monday.

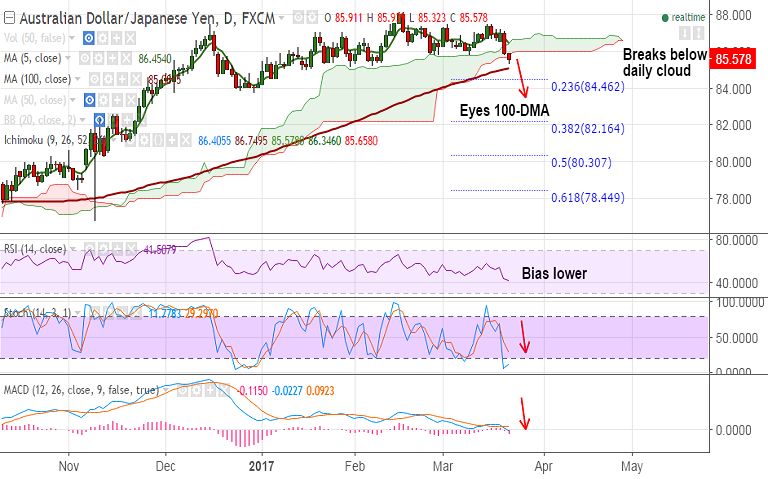

- AUD/JPY price action has dipped below daily cloud and is on track to test 100-DMA at 85.

- The pair is holding support by weekly 20-SMA at 85.32, break below will see further drag.

- Momentum studies on daily and weekly charts are biased lower. Bearish invalidation only above 20-DMA at 86.56.

Support levels - 85.32 (Weekly 20-SMA), 85.08 (100-DMA), 84.46 (23.6% Fib retrace of 72.437 to 88.176 rally)

Resistance levels - 86, 86.46 (5-DMA), 86.56 (20-DMA)

TIME TREND INDEX OB/OS INDEX

1H Neutral Oversold

4H Bearish Oversold

1D Bearish Neutral

1W Bearish Neutral

Recommendation: Good to go short on rallies around 85.70/80, SL: 86.50, TP: 85/ 84.50/ 84/ 83.75

FxWirePro Currency Strength Index: FxWirePro's Hourly AUD Spot Index was at -72.7375(Bearish), while Hourly JPY Spot Index was at 89.2696 (Bullish) at 0510 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.