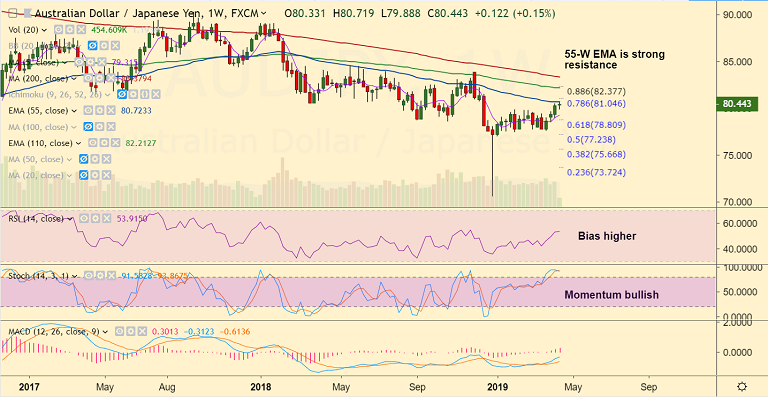

AUD/JPY chart - Trading View

- Aussie surged across the board lifting AUD crosses in the early Asian session after solid Chinese data.

- Data released showed a bigger-than-expected jump in the Chinese industrial production figures while the Q1 GDP numbers remained steady.

- China's YoY Q1 GDP came at +6.4 percent, above expectations at +6.3 percent and unchanged from +6.4 percent in the previous quarter.

- Industrial output YoY was a big beat on expectations, printing at +8.5 percent against +5.9 percent expected and +5.3 percent last.

- AUD/JPY is extending gains for the 4th straight week, hits 17-week high at 80.71 before paring some gains to currently trade at 80.46.

- Price has edged above 200-DMA and technical indicators are also bullish, supporting upside.

- The pair finds stiff resistance at 55-W EMA at 80.71 and decisive break above required for further upside.

- Break above 55-W EMA could see test of 110W EMA at 82.21. Retrace below 200-DMA will negate bullishness.

Call update: Our previous call (https://www.econotimes.com/FxWirePro-AUD-JPY-on-track-to-test-200-DMA-at-8025-good-to-go-long-on-dips-1525010) has hit all targets.

Recommendation: Book full profits. Watch out for break above 55W EMA for further upside.

For details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.