AUDJPY pops up flurries of bearish patterns on weekly as well as monthly charts, uptrend momentum exhausted at 50% Fibonacci retracements.

That is where shooting stars and hanging man patterns have occurred. As a result, we see the flurry of bearish streaks (refer both weekly & monthly charts).

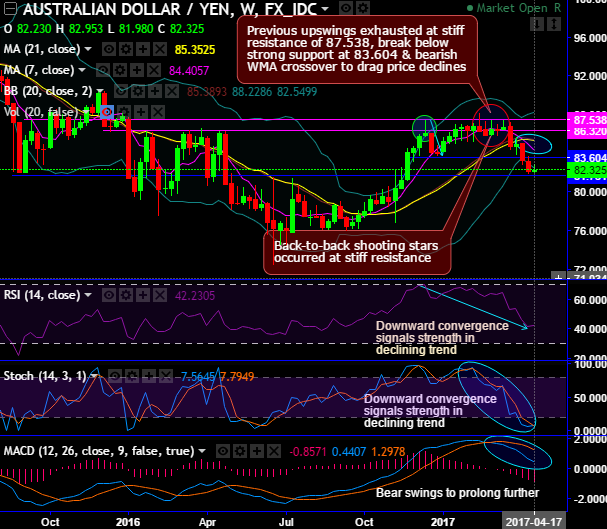

Back-to-back shooting stars occurred at the stiff resistance of 87.538 and 86.320 levels (see weekly charts) and at 84.124 & 86.325 levels respectively. Hanging man patterns have also occurred at 86.320 levels.

Consequently, AUDJPY bears have been unerringly extending below 38.2% Fibonacci retracement & 21-EMA with a bear candle with a big real body (refer monthly plotting).

Thereby, 8-9 months of consolidation pattern from the lows of 72.437 levels (Jun’16 lows) now seems to be exhausted.

To substantiate this bearish stance, the current prices slide below 21EMA, that is where the leading oscillators (RSI) is also sensing some sort of resistance at 65 levels, you observe the leading indicator gaining or struggling for strength in trend at this juncture (refer monthly plotting).

Same has been the case with stochastic curves that evidence the %D crossover right from the overbought zone (refer weekly plotting).

MACD also substantiates the similar bearish impact in the weeks to come.

Trade tips: – Contemplating above technicals, the tunnel spread is the best choice of speculation in prevailing price declines.

Well, contemplating above technical reasoning, on speculative grounds we advise tunnel spreads which are binary versions of the debit put spreads favoring bearish indications.

This strategy is likely to fetch leveraged yields than spot FX and certain yields keeping upper strikes at 83.604 and lower strikes at 81.731 levels.