Yen's gains from monetary policy: The BoJ's governor Kuroda has recently been emphasizing with suspicious frequency that his monetary policy is not aimed at changing the exchange rate. Of course the aim is to finally drive inflation up on a sustainable basis.

However, inflation seems to be just as unaffected by the BoJ's ultra-expansionary monetary policy as the exchange rates. January inflation data again didn't show any inflation increases.

The pressure on the BoJ has not eased following the introduction of negative interest rates on 29th January.

On the contrary, in view of the appreciation of the yen since early February it has risen further.

So it will be important to watch very carefully whether and if so how the BoJ's language changes as regards FX market interventions following the G20 summit.

Higher Implied Volatility and Put Ratio Back Spread: AUD/JPY

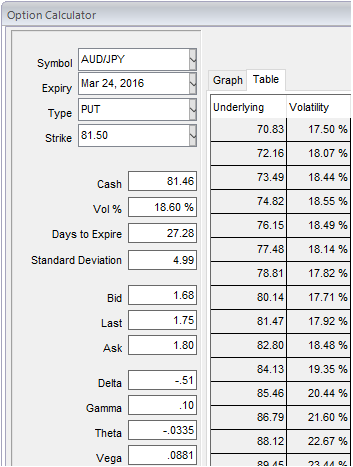

Traders tend to view the put ratio back spread as a bear strategy, because it employs puts. However, it is actually a volatility strategy. The implied volatility of 1M ATM put contract is at 18.6% and it is quite higher side which is good sign for the holders, while risk reversals for yen crosses are still scary, it is gaining against almost all majors.

As we expect the underlying currency exchange rate of AUDJPY to make a larger move on the downside. As shown in the figure purchase 1M 2 lots of At-The-Money -0.52 delta puts and sell 1W one lot of (1%) In-The-Money put option.

So far we all know that the position uses long and short puts in the ratio, such as 2:1 or 3:2 and so on to maximize returns depending upon risk appetite and returns expectations. In most long/short spreads, you make money if the underlying price moves, but you lose if it remains in the middle loss zone. Now with increased volatility option shorter can get benefitted from this.

Options with a higher IV cost more. This is intuitive due to the higher likelihood of the market 'swinging' in your favour. If IV increases and you are holding an option, this is good. You should also note short-dated options are less sensitive to IV, while long-dated are more sensitive.

A ratio put back spread is different because it creates a net credit, so even if the underlying price does not move very much, you keep the credit if all of the puts expire worthless.

Entering into this AUDJPY position which has higher implied volatility at 18.60% and expecting for the inevitable adjustment is a smart approach, regardless of the direction of price movement. Based on volatility and time decay, the strategy is a "price neutral" approach to options, and one that makes a lot of sense.

FxWirePro: AUD/JPY put ratio back spreads to hedge downside risks and to beat higher IVs

Friday, February 26, 2016 8:09 AM UTC

Editor's Picks

- Market Data

Most Popular