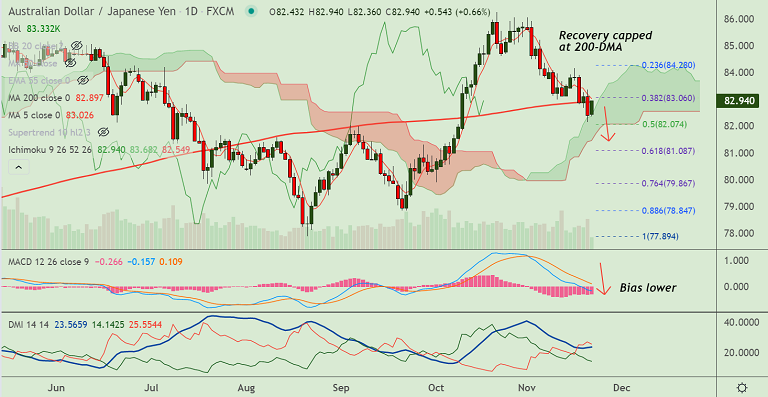

Chart - Courtesy Trading View

Technical Analysis: Bias Bearish

- Recovery attempts lack traction, scope for downside resumption

- Upside capped at 200-DMA, 5-DMA is sharply lower

- Volatility is high as evidenced by widening Bollinger bands

- Price action is below 200H MA and GMMA indicator shows strong bearish bias on the intraday charts

- Momentum is bearish, Stochs and RSI are sharply lower

- The pair has bounced off cloud support on the daily charts, break below will plummet prices

Support levels - 82.55 (110-EMA), 82.07 (50% Fib), 81.45 (Cloud base)

Resistance levels - 82.89 (200-DMA), 83.01 (5-DMA), 83.56 (21-EMA)

Summary: AUD/JPY trades with a bearish bias. Scope for resumption of downside. Dip till 81 levels likely. Bearish invalidation likely on retrace above 200-DMA.