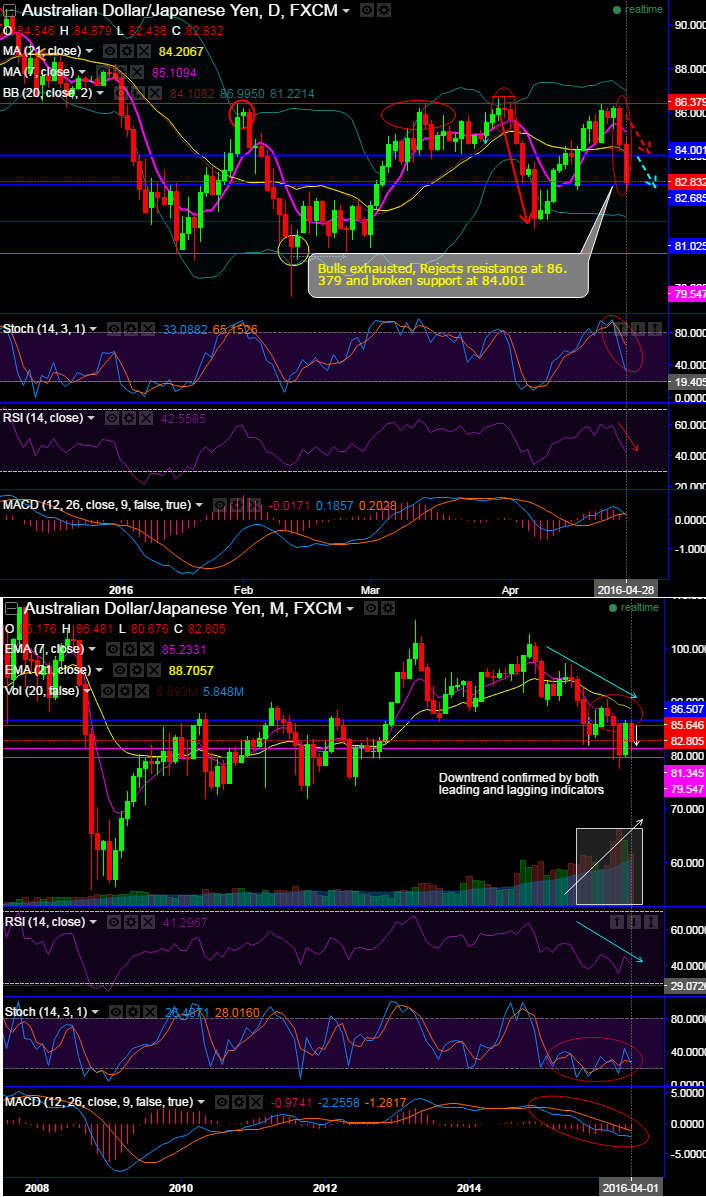

Bears needed 2 days trading sessions enough to wipe off 2 weeks of gains:

The pair after rejecting resistance at 86.368 levels, it was so easy for bears to resume their business.

In recent past, we had seen a “Long Legged Doji” forming at the same juncture (at peak of 86.173 levels to be precise), we can now understand intensity of the supply region at this point.

After rejecting this resistance, the current prices slid below DMAs (see daily charts).

In between the formation of two bearish candles with big real body, it has also broken support at 84.001 levels.

To substantiate this bearish stance, leading oscillators are so clearly converging downwards to these price slumps on both daily as well as monthly charts.

RSI is currently trending below 43 levels that signal the strength in bearish trend.

In addition to that, stochastic curves boiling up selling pressures above 80s by showing %D crossover which is overbought signal.

You can figure out from the monthly chart as well that the last month’s attempts of recovery has been showing weakness at 85.646 to drop below 21 &7 EMA curves as the strong supply seen at this level for this pair.

Massive volumes are in conformity to the major downtrend on monthly charts.

Most importantly, MACD with bearish crossover is just entering into bearish territory which would mean that swings are entering into new bearish environment.

Thus, on every rally would be deemed as a shorting opportunity rather than a fresh long build up. We could foresee short term bearish targets at 82.456 & below, and retest of 81.025 in medium run is also possible event.

Speculative Trade Idea: (Option Tunnel Spread)

Since, it has been breaking the support at 84.001 in just two days as stated above, we can understand how bears are active at the right time in this pair, no wonder if it hits 82.685 levels again or oscillates between 83.160 and 82.685 levels.

So on intraday terms, we rely on stochastic and RSI and as they pop up with overbought pressures thus far, so smart way to approach this pair is to deploy the option tunnel using ATM puts is structured as a binary version of a conventional put spread, i.e. long delta puts with higher strikes while writing the lower strikes for above mentioned targets on either side.