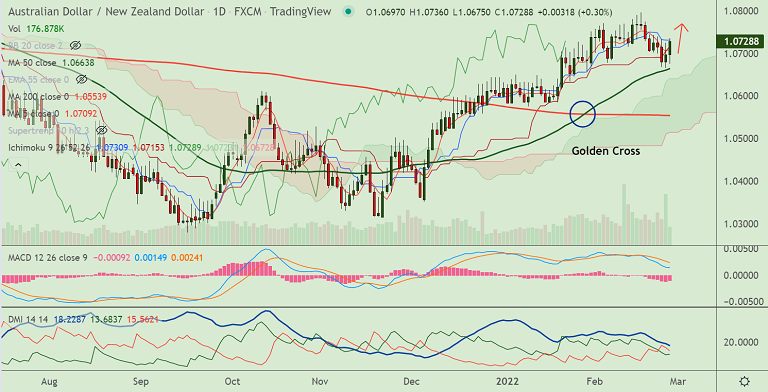

Chart - Courtesy Trading View

Technical Analysis: Bias Bullish

- AUD/NZD was trading 0.29% higher on the day at 1.0728 at around 10:25 GMT

- The pair is extending previous session's gains and bounce off lower Bollinger Band

- Price action has broken above 21-EMA and is testing 20-DMA resistance

- GMMA shows major trend is bullish, while minor trend is turning bullish on the daily charts

- Price action is above the daily cloud and Chikou span is biased higher, supporting upside

- 'Golden Cross' on the daily charts keep scope for upside

Support levels - 1.0711 (21-EMA), 1.0681 (Lower BB), 1.0663 (50-DMA)

Resistance levels - 1.0729 (20-DMA), 1.0777 (Upper BB), 1.0815 (Major trendline)

Summary: AUD/NZD showing potential for more upside. Bullish invalidation only below 50-DMA