AUD/NZD chart - Trading View

Fundamental News:

- Australia first quarter producer price inflation (PPI) numbers came in weaker-than-expected

- PPI rose 0.4 percent q/q in Q1, having risen by 0.5 percent in the previous quarter, missing market expectations at 0.6 percent.

- The annualized figure also came in a tad weaker-than-expected at 1.9 percent.

Technical Analysis:

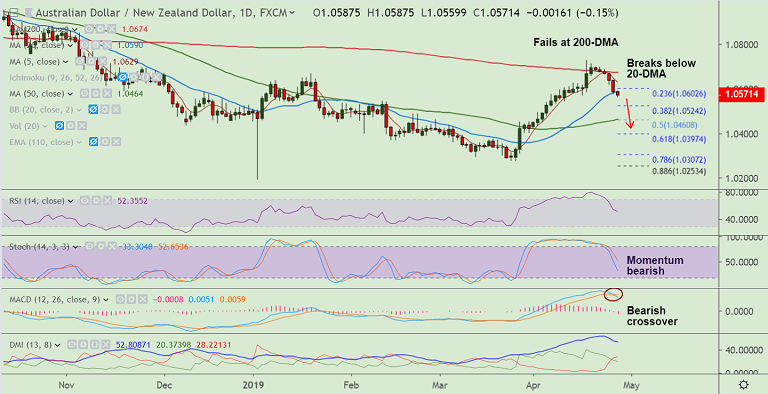

- Price action extending weakness for the 6th straight session

- Upside rejected at 200-DMA, slips below 20-DMA support

- Stochs and RSI have turned lower, -ve DMI crossover on +ve DMI

- MACD is showing a bearish crossover on signal line

- Scope for weakness till 50-DMA at 1.0464. Bearish invalidation above 200-DMA

Support levels - 1.0545 (110-EMA), 1.0519 (55-EMA), 1.0464 (50-DMA)

Resistance levels - 1.0590 (20-DMA), 1.0629 (5-DMA), 1.0674 (200-DMA)

Recommendation: Good to go short on upticks, SL: 1.0630, TP: 1.0524/ 1.05/ 1.0465

For details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

FxWirePro: AUD/NZD Trade Idea

Friday, April 26, 2019 5:10 AM UTC

Editor's Picks

- Market Data

Most Popular