NZD was solid overnight. It is difficult to come up with likely catalysts for large moves in the NZD in the New Zealand session today, with no data or speeches due. The upward trend, which has been apparent since mid-January with the only down month being May, remains in place.

NZD initially rose from 0.7275 to 0.7335, consolidating to 0.7300. AUD/NZD extended a two-week old decline to 1.0413 – last seen on 11 July.

Monetary policy wise, both RBA and RBNZ has still got potential to cut policy rates.

Technically, bears managed to break supports at the neckline of the double top (at 1.0433 on daily charts). Despite minor upswings in a short run, the major declining trend is in conformity to the volumes and both leading lagging indicators.

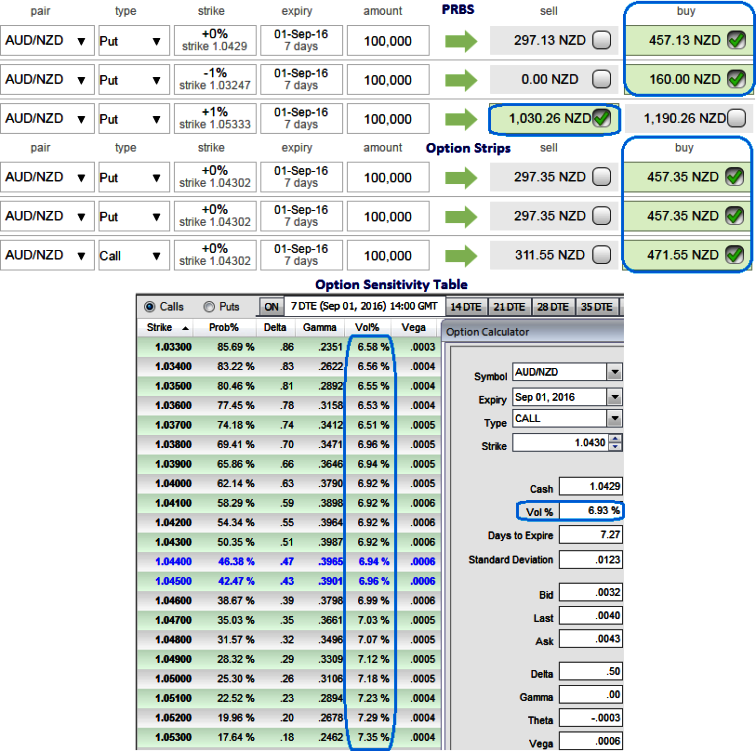

Well, in order to arrest this short term upside risk and major downtrend, we run you through the differential values between both option spreads and combination strategies contemplating FX OTC market indications.

1W at the money volatilities of 50% delta calls and puts are hovering between 6.5% - 7.5% which is reasonable as the vols currently are working in the interest of option writers as you can see IVs and corresponding movements in vega.

The current 1w IVs that favour underlying spot’s upside bias but through option writing rather than holding.

Please be noted that the cost of hedging reduces in the case of put ratio back spread, which is considerably lower than that of option strips strategy = NZD 1647.39 in the case of PRBS and NZD 1386.25 for option strips strategy, Hence, hedger can also achieve the cost advantage.

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays