AUD/NZD chart - Trading View

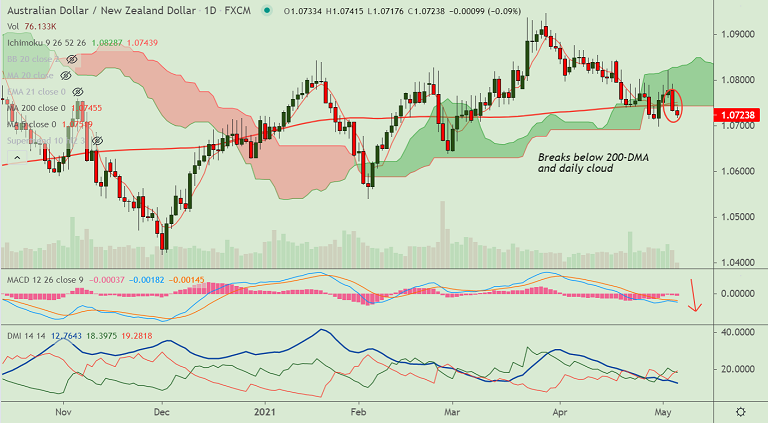

AUD/NZD was trading 0.09% lower on the day at 1.0724 at around 05:20 GMT, outlook bearish.

The pair has closed below 200-DMA and daily cloud on the previous day's trade and is set to extend losses.

Aussie under pressure after China says to end 'strategic economic dialogue' and "indefinitely suspend" all activities under the China-Australia Strategic Economic Dialogue.

Weakening risk sentiment across markets and the US dollar strength exerting additional pressure on the pair.

Momentum indicators are biased lower, MACD supports downside in the pair. Chikou span is biased lower and adds to the downside bias.

Price action is below 200H MA and GMMA indicator shows minor trend is bearish, while major trend is turning bearish.

The pair is currently hovering around minor trendline support at 1.0725, break below will see dip till 61.8% Fib at 1.0620.