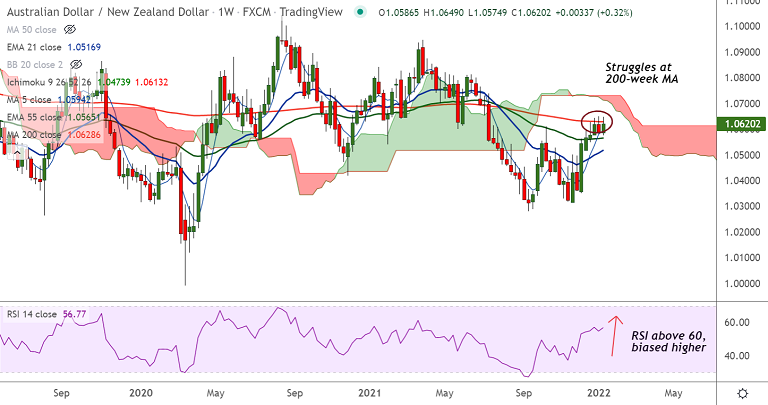

Chart - Courtesy Trading View

Technical Analysis: Bias turning Bullish

- AUD/NZD consolidates above 200-DMA, upside remains capped at 200-week MA

- GMMA indicator shows major and minor trend are bullish on the daily charts

- RSI is above 60, biased higher, Stochs have turned bullish

- Price action is above cloud and Chikou span is biased higher

- Bollinger bands are constricting, volatility is low

Support levels - 1.0693 (5-DMA), 1.06 (20-DMA), 1.0587 (21-EMA)

Resistance levels - 1.0628 (200-week MA), 1.0650 (Jan 5th high), 1.0662 (Upper W BB)

Summary: AUD/NZD struggles at 200-week MA, decisive break above required for upside continuation. Technical studies are turning bullish. Bullish invalidation likely on retrace below 200-DMA.