- Aussie buoyed following news of higher-than-expected corporate profits for Q1 2017.

- Business indicators shows Australia's company profits gain 6.0% while business inventories up 1.2% in Q1.

- Further, stronger-than-expected Caixin Chinese services PMI provided an additional boost to the China-proxy Australian Dollar.

- AUD/NZD has closed a bearish gap down open and edged higher to currently trade at 1.0473 levels.

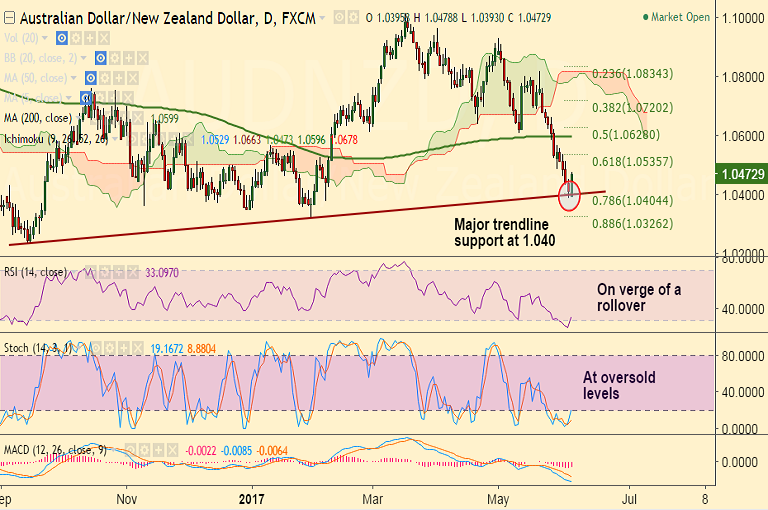

- The pair failed to close below major trendline support at 1.040 on Friday. We see further weakness only on break below.

Support levels - 1.040 (trendline), 1.0354 (Dec 29 & 30 2016 low), 1.0326 (Jan 31 low)

Resistance levels - 1.0466 (5-DMA), 1.0535 (61.8% Fib), 1.0599 (200-DMA), 1.0631 (20-DMA)

Call update: Our previous call (http://www.econotimes.com/FxWirePro-AUD-NZD-slumps-to-fresh-multi-week-lows-bias-lower-test-of-104-likely-733677) has hit all targets.

Recommendation: Book full profits at lows. Markets remain wary ahead of the RBA monetary policy decision on Tuesday.

FxWirePro Currency Strength Index: FxWirePro's Hourly AUD Spot Index was at 162.49 (Bullish), while Hourly NZD Spot Index was at 58.3908 (Neutral) at 0630 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.