In our recent technical write-up, we’ve explicitly stated that the AUDNZD to keep inching higher in short run but major downtrend remains intact. For more details, visit below website:

The three-day-old rebound has potential to continue into the 1.0500 area, helped by firming iron ore prices.

AUDNZD medium term perspectives: Likely to edge higher towards 1.08. The cross remains below fair value estimates implied by interest rates, commodity prices and risk sentiment, although it is closing the gap. There’s potential for a rebound in iron ore prices this year, given high steel prices.

OTC Outlook & Option Strategy:

ATM IVs of AUDNZD is trading between 6.25 and 6.3% for 1 and 2m tenors respectively.

Please also be noted that the options with a higher IV cost more which is why in this case OTM puts have been preferred over ATM instruments. This is intuitive due to the higher likelihood of the market ‘swinging’ in your favor. If IV increases and you are holding an option, this is good. When you write an option, the seller wants IV to remain lower level or to shrink so the premium also fades away.

Thus, on hedging grounds, conservative hedgers can prefer the below strategy regardless of the swings in the underlying spot FX:

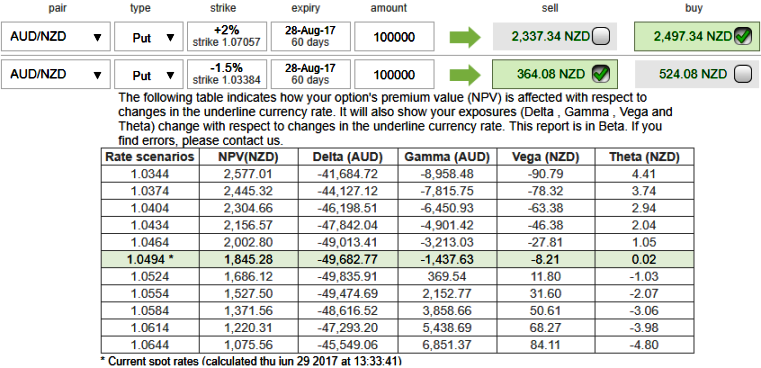

Debit Put Spread = Go long 2M (2%) ITM -0.66 delta put option, simultaneously, short (1.5%) OTM put with lower strike price with net delta should be at 50%00.

For a net debit bear put spread reduces the cost of trade by the premium collected (on the shorts of OTM put) and keeps option trader to participate in downward moves and any upswings in abrupt.

Moreover, the risk is capped to the extent of initial premium paid, as opposed to unlimited risk when short selling the underlying outright.

However, put options have a limited lifespan. If the underlying FX price does not move below the strike price before the option expiration date, the put option will expire worthless.

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary