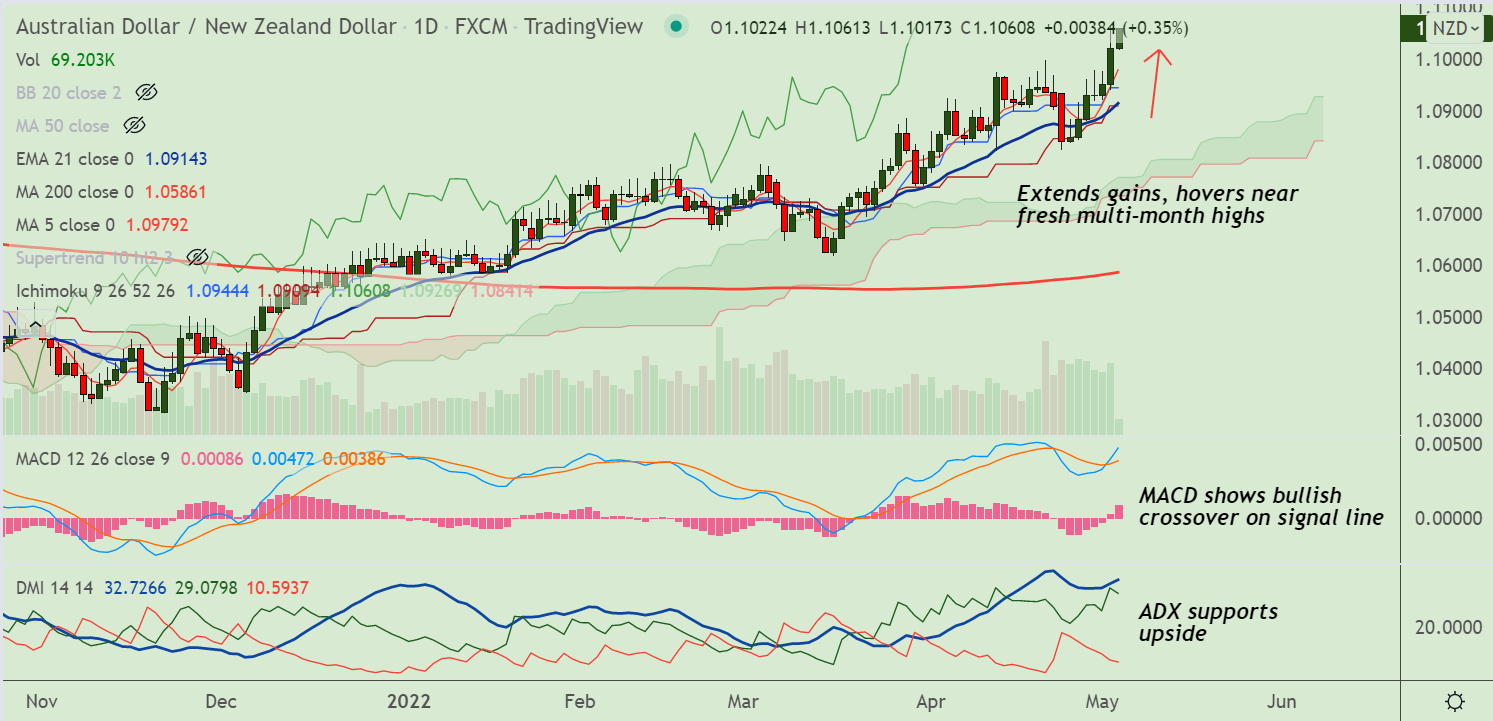

Chart - Courtesy Trading View

AUD/NZD was trading 0.35% higher on the day at 1.1060 at around 06:25 GMT.

The pair is extending gains for the seventh straight session, outlook remains bullish.

The Reserve Bank of Australia’s (RBA) hawkish bias and readiness for more such moves keeps the Aussie supported.

On the data front, Australia’s Retail Sales for March rose past 0.6% market consensus to 1.6%, versus 1.8% prior.

Australia’s S&P Global Services and Composite PMIs eased below the previous readouts of 56.2 and 56.6 to 55.9 and 56.1 respectively.

Technical Analysis shows more upside for the pair. MACD confirms bullish crossover on signal line. ADX supports upside.

Stochs and RSI are sharply higher. Price action is above cloud and Chikou span is biased higher.

Support levels:

S1: 1.0977 (5-DMA)

S2: 1.0913 (21-EMA)

Resistance levels:

R1: 1.12

R2: 1.1290 (Oct 2017 high)

Summary: AUD/NZD trades with a bullish bias. The pair is on track to test 1.12 mark.