- Kiwi falls against major peers as business confidence, capacity utilisation data fail to meet expectations.

- New Zealand Q3 business confidence fell to an 18-month low of 5 pct vs 18 pct in the previous quarter.

- On the other side, Australia August building approvals increase to 0.4 % (forecast -0.5 %) vs previous -1.2 % (revised from -1.7 %).

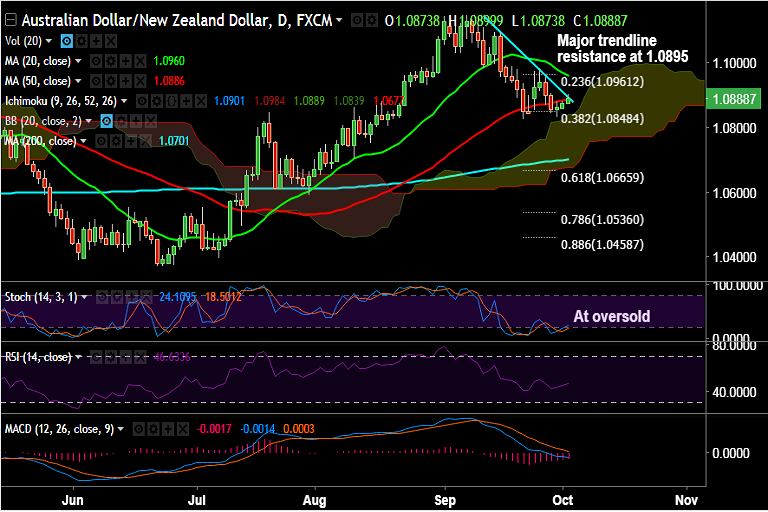

- AUD/NZD is extending gains for 3rd successive session, struggles at stiff trendline resistance at 1.0895.

- Technical studies still bearish, only breakout above 20-DMA could see further upside.

- Techs on weekly charts are biased lower. RSI has turned lower from near overbought levels and Stochs are on the verge of rollover from overbought levels.

- Stiff resistance lies at 1.1155 (major trendline), only decisive break above could see further upside.

Support levels - 1.0886 (50-DMA), 1.0875 (5-DMA), 1.0848 (38.2% Fib retrace of 1.0370 to 1.1143 rise), 1.0744 (Weekly 200-SMA), 1.07

Resistance levels - 1.0895 (trendline), 1.0960 (20-DMA), 1.0978 (Sept 26 high)

Recommendation: Watch out for decisive breakout above 1.0895 for further upside, target 1.0960/ 1.0980.

FxWirePro Currency Strength Index: FxWirePro's Hourly AUD Spot Index was at -21.4341 (Neutral), while Hourly NZD Spot Index was at 13.9067 (Neutral) at 0640 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest