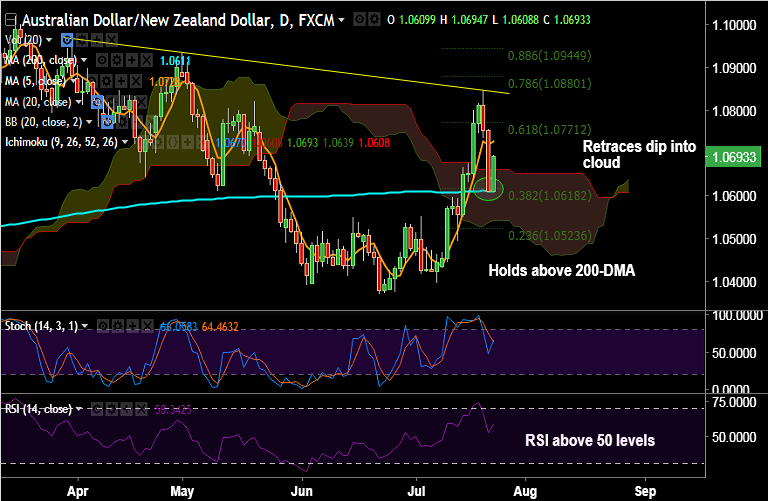

- AUD/NZD retraces brief dip below 200-DMA at 1.0611, intraday bias higher.

- The pair has reclaimed the 1.07 handle after breaking above 100-DMA at 1.0987.

- Price action has reversed dip into daily cloud and cloud top at 1.0662 is strong support.

- Technical indicators on weekly charts are highly bullish, RSI strong above 50, Stochs are biased higher and MACD is on verge of bullish crossover.

- We see scope for test of trendline resistance at 1.0840 and bullish invalidation only on break below 200-DMA at 1.0611.

Support levels - 1.0662 (cloud top), 1.0618 (38.2% Fib), 1.0611 (200-DMA)

Resistance levels - 1.07, 1.0728 (5-DMA), 1.0771 (61.8% Fib retrace of 1.1018 to 1.0370 fall)

Recommendation: Good to go long on dips around 1.0680/85, SL: 1.0610, TP: 1.07/ 1.0770/ 1.08/ 1.0840

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest