Fundamental Factors:

- Aussie dumped on dismal Australia's inflation data. Australia core CPI prints at record lows raising odds of the RBA rate cut.

- Data showed Australia core CPI fell to record low of 1.6% y/y. The ‘trimmed mean’ figure tracked by the RBA came in at 0.4% q/q, which is below the market estimate of 0.5%.

- The two-year yield fell one basis point, while the 3-year yield shed close to two basis points. The weakness in the yields at the short-end of the curve highlights heightened odds of the RBA rate cut.

Technical Studies:

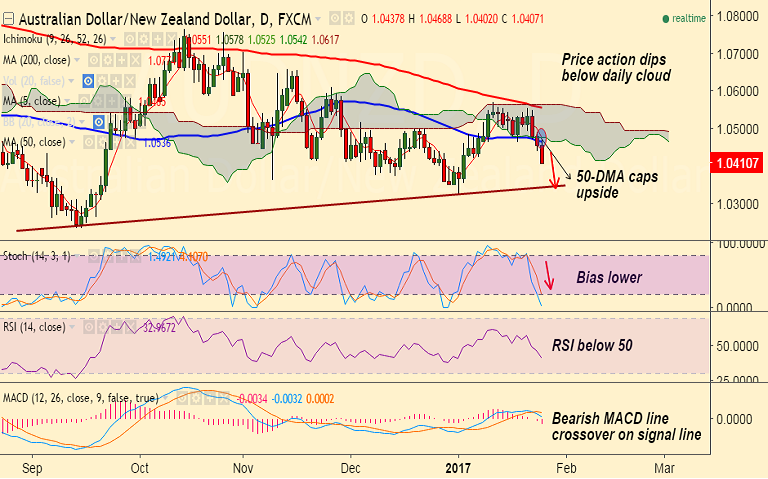

- AUD/NZD price action dips below daily Ichi cloud, bearish bias builds on daily charts.

- The pair has slipped below 50-DMA and is on track to test trendline at 1.0345.

- MACD line shows bearish crossover on signal line, Stochs have rolled over and RSI is below 50 and biased lower.

Support levels - 1.0355 (Jan 3 low), 1.0345 (trendline), 1.0327 (Jan 2 low)

Resistance levels - 1.0466 (50-DMA), 1.0477 (cloud top), 1.0498 (100-DMA)

Call update: Our previous call (http://www.econotimes.com/FxWirePro-AUD-NZD-breaks-below-daily-cloud-bias-lower-good-to-sell-rallies-502431) has hit TP1&2.

Recommendation: Bias lower. Book partial profits, lower trailing stops to 1.0480, stay short for 1.0345.

FxWirePro Currency Strength Index: FxWirePro's Hourly AUD Spot Index was at -103.564 (Highly bearish), while Hourly NZD Spot Index was at 19.1372 (Neutral) at 0500 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.