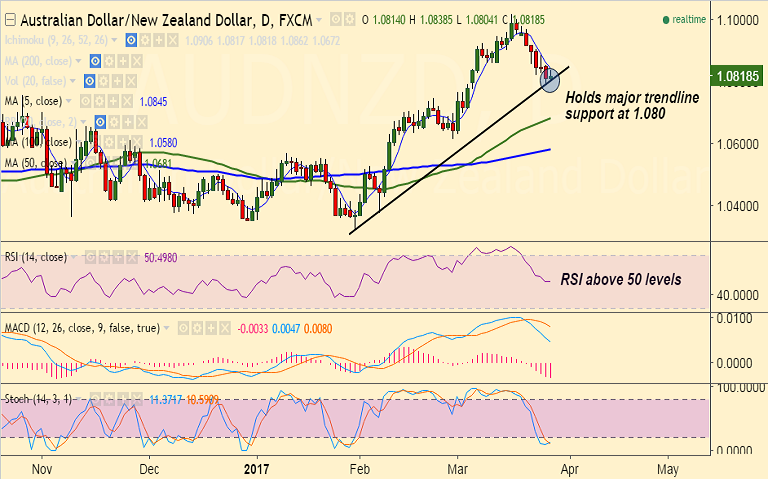

- AUD/NZD edges higher after holding major trendline support at 1.080.

- We see further weakness only on break below.

- Price action in the pair is raging above daily cloud and all major moving averages.

- RSI is also holding above 50 mark and Stochs are at oversold region.

- On the flipside, break above 5-DMA could see near-term reversal in trend.

Support levels - 1.080 (trendline), 1.0778 (Mar 6 lows), 1.0681 (50-DMA)

Resistance levels - 1.0846 (5-DMA), 1.0875 (20-DMA), 1.09, 1.0907 (1H 200-SMA)

TIME TREND INDEX OB/OS INDEX

1H Bearish Neutral

4H Neutral Neutral

1D Neutral Neutral

1W Bearish Neutral

Recommendation: Watchout for break above 5-DMA at 1.0846 to go long.

FxWirePro Currency Strength Index: FxWirePro's Hourly AUD Spot Index was at -146.6 (Bearish), while Hourly NZD Spot Index was at -95.0228 (Bearish) at 0730 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.