- Kiwi extends weakness after weaker than expected trade balance data and NZIER’s recommendations of little need for an RBNZ rate rise.

- New Zealand trade balance for August came in at $-3.2B, below forecasts at $-2.91B.

- NZ business confidence stood at 0.0 pct in September vs 18.3 pct in previous survey, while own activity outlook fell to 29.6 pct vs 38.2 pct prior.

- The country's election results provided no clear victory and resulted in a hung parliament.

- On the other side, firmer oil, copper and gold prices also lifted the sentiment around the resource-linked AUD.

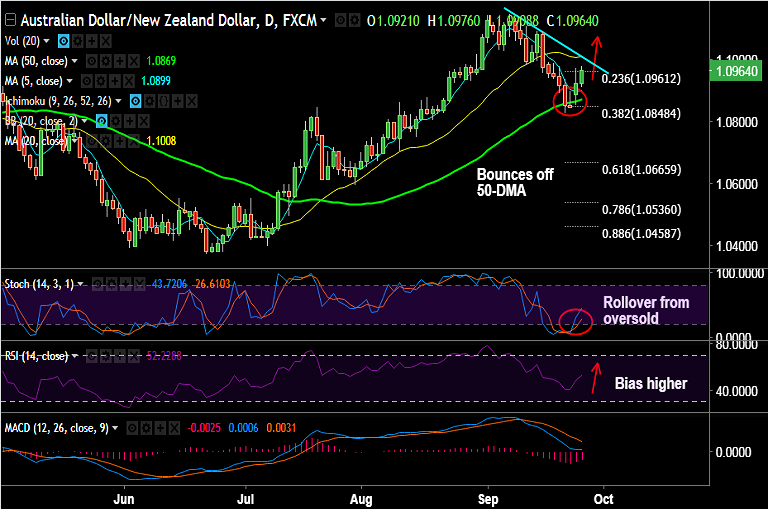

- Technical studies have turned bullish, we see rollover of stochs from oversold levels.

- The pair has bounced off 50-DMA and is on track to test major trendline resistance at 1.10 levels.

- Violation a 1.10 could then see 1.1155 (major trendline resistance).

Support levels - 1.0899 (5-DMA), 1.0869 (50-DMA), 1.0848 (38.2% Fib retracement of 1.0370 to 1.1143 rally)

Resistance levels - 1.10 (converged weekly 5-SMA, 20-DMA and trendline), 1.1155 (major trendline resistance)

Recommendation: Good to go long on dips around 1.0950/55, SL: 1.09, TP: 1.10/ 1.1045/ 1.1090

FxWirePro Currency Strength Index: FxWirePro's Hourly AUD Spot Index was at -37.4816 (Neutral), while Hourly NZD Spot Index was at -70.0669 (Neutral) at 0445 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest