Finally sustained the break above the very important 1.0765 area, and now targets 1.0875 (Feb 2016 minor peaks) during the week ahead.

The cross remains well below fair value estimates implied by interest rates, commodity prices, and risk sentiment, although is closing the gap. Majorly for valuation reasons, the cross remains well below fair value estimates implied by interest rates, commodity prices and risk sentiment. As a result, interim rallies likely to extend

AUDNZD major downtrend seems to be intact despite recent bull swings, amid abrupt rallies the next major target 1.0527, 1.0340 or even 1.0156 can also not be disregarded.

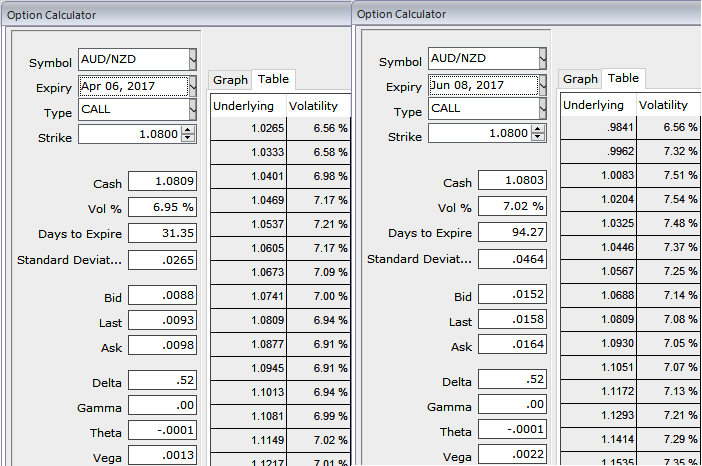

Please be noted that the implied volatility of at the money contracts of this APAC pair has been trading at a tad below 7% and 7.02% for 1m and 3m tenors respectively. Lower IV environment has been conducive for option writers, while vega instruments of 3m tenor are signifying the hedgers’ interests in downside risks.

So, the speculators and hedgers for bearish risks are advised to optimally utilize the upswings in short run as the lower implied vols are conducive for option writers, accordingly, we had advised ITM shorts in put ratio back spreads and as the underlying spot FX has risen a bit, the writers could have pocketed the premiums that they have received from these shorts.

AUDNZD's lower IVs with theta’s interest on ITM put strikes could be interpreted as the option writer’s opportunity in short run.

Weighing up all above aspects, we eye on loading up with fresh longs for long-term hedging, more number of longs comprising of ATM instruments and ITM shorts in short term would optimize the strategy.

So, the execution of hedging positions goes this way:

Go long in 1 lot of long in 3m ATM +0.49 delta put options, 1 lot of long in 3m (1%) OTM -0.32 delta put options, simultaneously, stay short 1m (1%) ITM put option, the position may gain if the underlying spot FX abruptly shows any mild gains. The strategy should be constructed at net debit with net delta at around -0.40.

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms