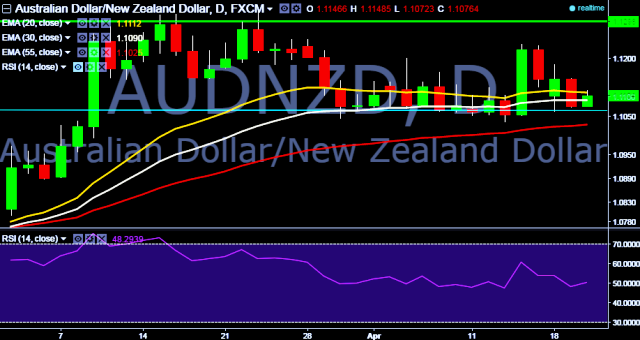

- AUD/NZD is trading around 1.1097 marks.

- Pair made intraday high at 1.1117 and low at 1.1076 marks.

- The New Zealand dollar was the strongest performer among the majors on Tuesday after the strongest rise in dairy prices in six months.

- Fonterra's fortnightly Global Dairy Trade auction concluded with a 3.8% rise in dairy prices, the biggest increase since early October.

- In addition, overnight the main driver for the Aussie was RBA Governor Glenn Stevens' speech, in which he highlighted the limits to monetary policy, taking a stab at other central banks which have adopted extreme policy measures to support their economies.

- Intraday bias remains bullish till the time pair holds key support at 1.1062 marks.

- A daily close below 1.1062 will take the parity down towards 1.1016/ 1.0934 marks.

- On the other side, initial resistances are seen at 1.1123/1.1298/1.1352/1.1590 marks.

We prefer to take long position in AUD/NZD only above 1.1123, stop loss 1.1062 and target 1.1220/ 1.1260 marks.