AUDNZD in short run: The corrective declines have so far retraced over 50% of the Sep/Oct rally. It has scope to extend this retracement to 62% or 1.0440.

10D at the money volatilities of 50% delta calls are just shy below 10% which is reasonable as the vols currently are working in the interest of option holders as the underlying spot FX price of AUDNZD moving in sync with the corresponding movements in vega.

Contemplating the current trend of this pair, the ATM IVs are creeping up above 9.75% of 10d tenor that favor option holding in short run.

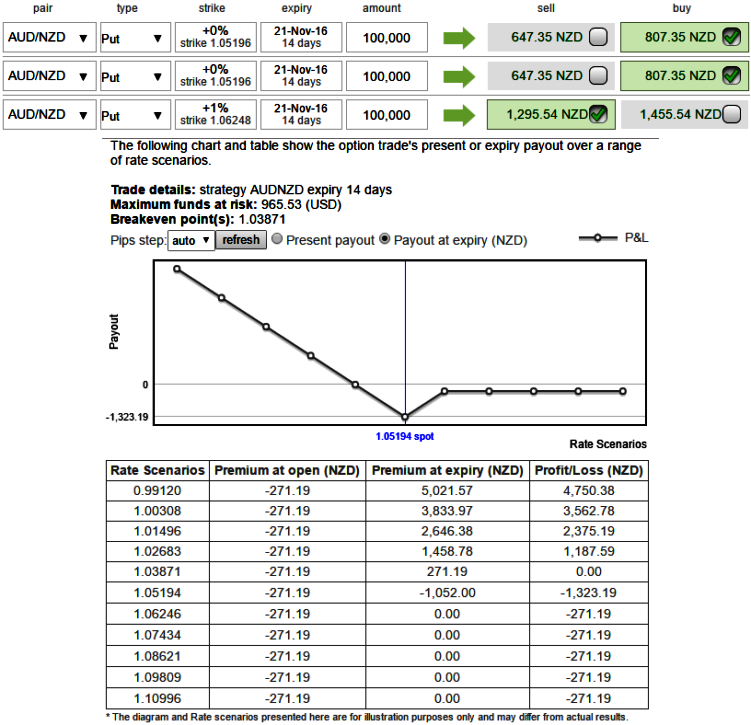

So, one can think of ATM longs in put ratio backspreads coupled with writing ITM puts with narrowed tenor.

As a result, you can probably make out from the nutshell evidencing payoffs that the every rise in spot price would add leveraging effects in payoff structure, yes, they seem exponential with healthy movements in vega.

The typical position combines buying at-the-money or out-of-the-money puts and, at the same time, selling a smaller number of in-the-money puts. Those in-the-money puts are always at risk of exercise, but you have two advantages.

First, the assignment can be covered by the long puts; second, time decay and implied volatility work in your favor on the short puts. This points out the importance of entering the position when implied volatility is higher than average.

The short position puts (which are in the money) will yield more premium income than the cost of the higher number of at- of out-of-the-money long positions. The ratio itself should vary depending on your belief in the strength, direction and timing of price movement, and also on the cost for each side. Creating a net credit is always desirable, so this also affects how many short and long puts you open.

Another issue is determining which strikes you should use in this strategy. The broader the strike difference between short and long puts, the fewer puts you need to sell to cover the price of the long puts. But at the same time, the coverage of long-to-short is going to be more difficult in the event of assignment.

Please note that the tenors used in the diagram are just for the demonstration purpose, narrowed expiry is preferred.

2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics