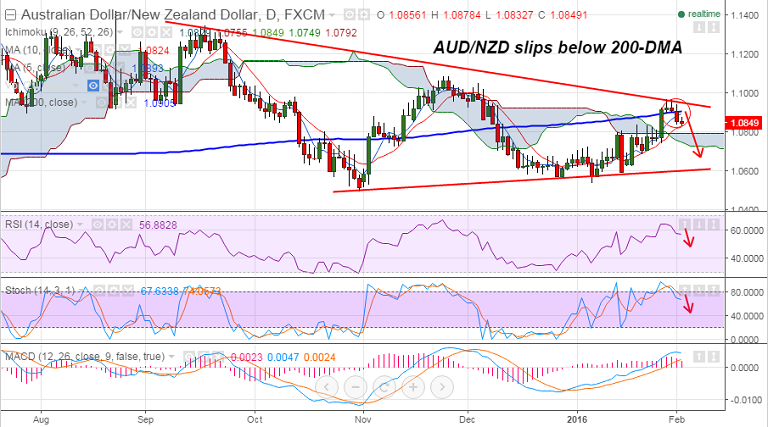

- AUD/NZD edges lower after being rejected at trendline resistance by 1.0970, currently trades at 1.0850.

- The pair slipped and closed below 200-DMA (currently at 1.0905) in Monday's trade raising scope for further downside.

- 200-DMA at 1.0905 now flips to resistance, bearish invalidation on breaks above.

- Supports on downside lie at 1.0824 (10-DMA), 1.0792 (cloud-top), 1.0752 (Jan 26 lows).

- Daily Techs are biased lower, Stochs show a bearish crossover from overbought levels, while RSI also points south.

Recommendation: Good to sell rallies around 1.0850/60, SL: 1.0910, TP: 1.0790/50