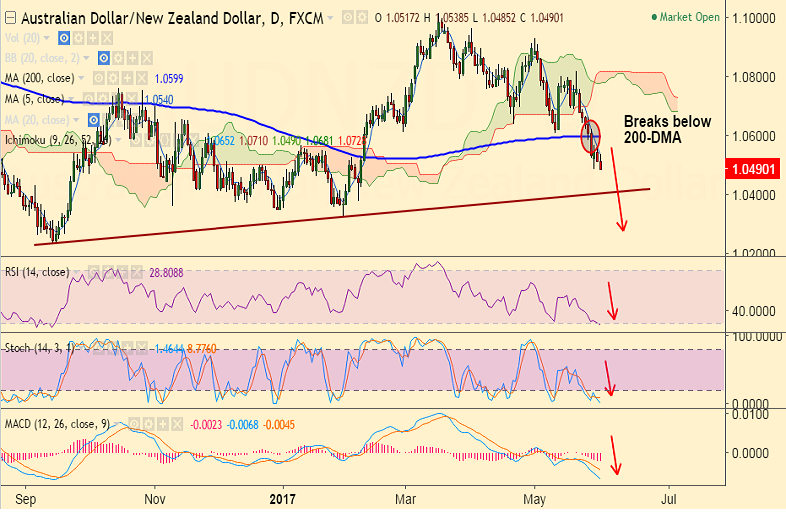

- AUD/NZD trades with a weak bias, scope for test of 1.04 levels.

- The pair has broken below 200-DMA and price action well below daily cloud.

- Technical studies are highly bearish, but RSI and Stochs at oversold levels, so some caution advised.

- We see bearish invalidation only above 200-DMA at 1.0599 levels.

- Next immediate support seen at 1.0472 (Sept 30 2016 low). Break below will see test of 1.0418 (76.8% Fib) and then trendline at 1.040.

Support levels - 1.0472 (Sept 30 2016 low), 1.0418 (76.8% Fib), 1.040 (trendline)

Resistance levels - 1.0540 (5-DMA), 1.0599 (200-DMA), 1.0674 (20-DMA)

Recommendation: Good to go short on rallies around 1.0510/20, SL: 1.06, TP: 1.0475/ 1.0420/ 1.04

FxWirePro Currency Strength Index: FxWirePro's Hourly AUD Spot Index was at 45.4327 (Neutral), while Hourly NZD Spot Index was at 126.752 (Bullish) at 1020 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.