- Dismal Australia retail trade data weighing heavily on the Aussie, drags AUD/NZD lower.

- Australia retail sales posted their biggest fall in about four-and-a-half years, plunging 0.6 percent in August.

- Downbeat retail sales fuelled concerns over the economic outlook, raising scope for RBA to stay pat for longer.

- The Kiwi dented on New Zealand Finance Minister Joyce’s comments. FM said future surpluses may not be wider than forecast.

- AUD/NZD hit 3-week highs at 1.0993 before edging lower to currently trade at 1.0934 levels.

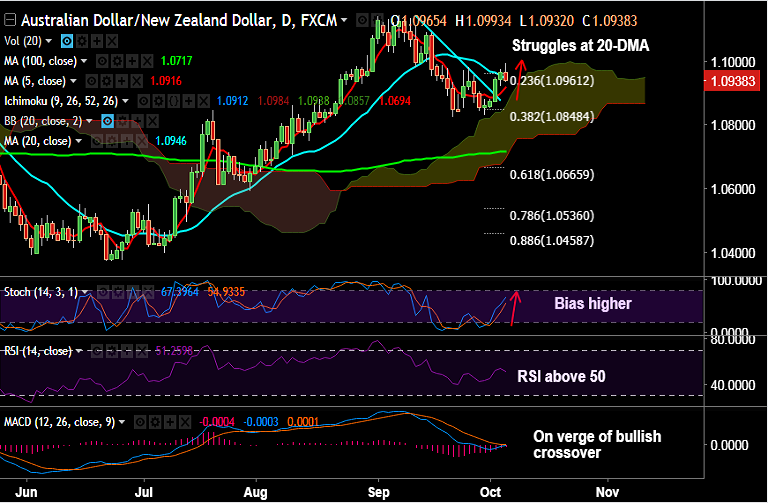

- The pair is struggling to hold above 20-DMA support at 1.0946, close below could see minor weakness.

- Technical studies are bullish, we see scope for further upside. Bullish invalidation only on close below 5-DMA at 1.0915.

Support levels - 1.0915 (5-DMA), 1.0899 (50-DMA), 1.0848 (38.2% Fib retrace of 1.0370 to 1.1143 rise)

Resistance levels - 1.0946 (20-DMA), 1.0961 (23.6% Fib), 1.0978 (Sept 26 high)

Call update: Our previous call (https://www.econotimes.com/FxWirePro-AUD-NZD-finds-stiff-resistance-at-10895-further-upside-only-on-break-above-930822) has hit all targets.

Recommendation: Watch out for decisive break above 20-DMA for further upside.

FxWirePro Currency Strength Index: FxWirePro's Hourly AUD Spot Index was at -46.2801 (Neutral), while Hourly NZD Spot Index was at -101.565 (Bearish) at 0630 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest