- Upbeat Australia exports & China non-manufacturing PMI pushed AUD/JPY higher in the Asian session.

- The Reserve Bank of Australia (RBA) at its monetary policy meeting today, left the official cash rate (OCR) unchanged at a record low of 1.50%, as widely expected.

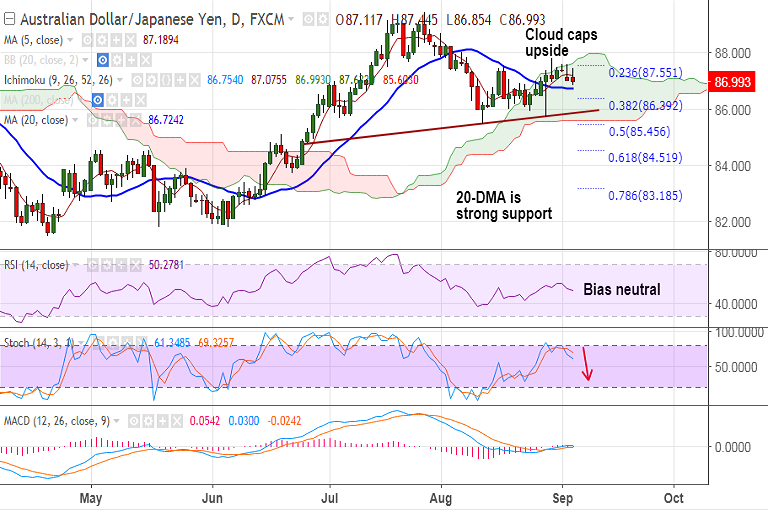

- The pair was rejected at highs, has slipped lower from 87.44 levels to currently trade around 87.

- We had evidenced a possible 'Bullish Bat' formation on daily charts and the pair is extending downside in continuance.

- Downside now finds next major support at 20-DMA at 86.72. Break below will see drag till trendline at 85.90.

- Cloud caps upside, decisive breakout above could see extension till 89.80 (trendline).

Support levels - 86.72 (20-DMA), 86.44 (23.6% Fib retrace of 76.78 to 89.42 rally), 85.70 (Aug 29 low), 85.38 (200-DMA)

Resistance levels - 87.63 (cloud top), 87.94 (Sept 1 high), 88.15 (Feb 15th high), 88.70 (Aug 1 high), 89.80 (trendline)

Call update: We had advised a short in our previous call (http://www.econotimes.com/FxWirePro-Possible-Bullish-Bat-on-AUD-JPY-good-to-short-break-below-8677-880507).

Recommendation: Hold for targets.

FxWirePro Currency Strength Index: FxWirePro's Hourly AUD Spot Index was at -10.3614 (Neutral), while Hourly JPY Spot Index was at 98.0286 (Bullish) at 0440 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest