AUDUSD downside risks remain intact, the next target 0.7070 and below 0.70 levels in medium terms.

Medium-term perspective: The FOMC’s dovish shift may have driven Aussie towards near 0.73 levels while the RBA’s subsequent turn towards neutral stance caused multi-week lows around 0.7050.

RBA's rate cuts during H2 certainly hurts the AUD but data isn’t likely to stoke much more pricing of rate cut risk before August.

Amid these monetary policy turbulence, anyone, if at all, is holding AUDUSD call spread with the optimism that USD would come under modest pressure in the wake of the dovish FOMC and that AUD was well placed to capitalize on this given the already inverted slope of the Australian yield curve, it is wise to insulate AUD rates from the inevitable re-think of global monetary policy.

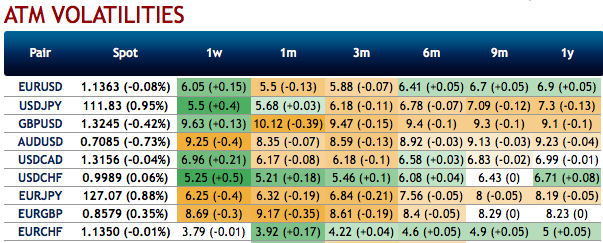

Most importantly, let’s just quickly glance through AUD’s OTC markets. The bearish risk reversals coupled with IV skews of this pair across all tenors indicate downside risks remain intact. While the implied volatilities (IV) are also shrinking below 9% for 1m – 6m tenor which is not conducive for call options holders. As a result, good to unwind the call options positions.

Benefiting from the shift in the monetary policy sentiments seemed unjustifiable, as especially the RBA, which unexpectedly dropped its implicit tightening bias and thereby allowed the domestic market to more fully price a rate cut over the coming year.

Chances are that the market will bring forward its pricing for ease unless the domestic data improves quickly, and so whereas last week we believed there was value holding this trade as a low-delta option on resolution to US-China trade conflict, this week we take losses and exit the trade as it seems that the domestic policy risks to AUD are liable to intensify.

The danger now for AUD is that it starts to decouple from other high-beta assets, and if so there is likely to be value in using AUD to fund exposure in other high-beta currencies to benefit from either an early stage pick-up in global growth or de-escalation of a trade conflict. Potential de-correlation trades include selling AUDUSD calls to fund selective long EM exposure or owning hybrid options such as dual digitals with AUD lower/US equities higher. Nevertheless, Australia’s key export prices have improved, and US-China trade relations seem most likely to cause some sort of deal.

Well, on hedging grounds, we advocate shorting futures contracts of mid-month tenors as the underlying spot FX likely to target southwards below 0.70 levels in the medium run. Writers in a futures contract are expected to maintain margins in order to open and maintain a short futures position. Courtesy: Sentrix, JPM & Saxobank

Currency Strength Index: FxWirePro's hourly AUD spot index is inching towards -105 levels (which is bearish), while hourly USD spot index was at 57 (bullish) while articulating (at 07:32 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data