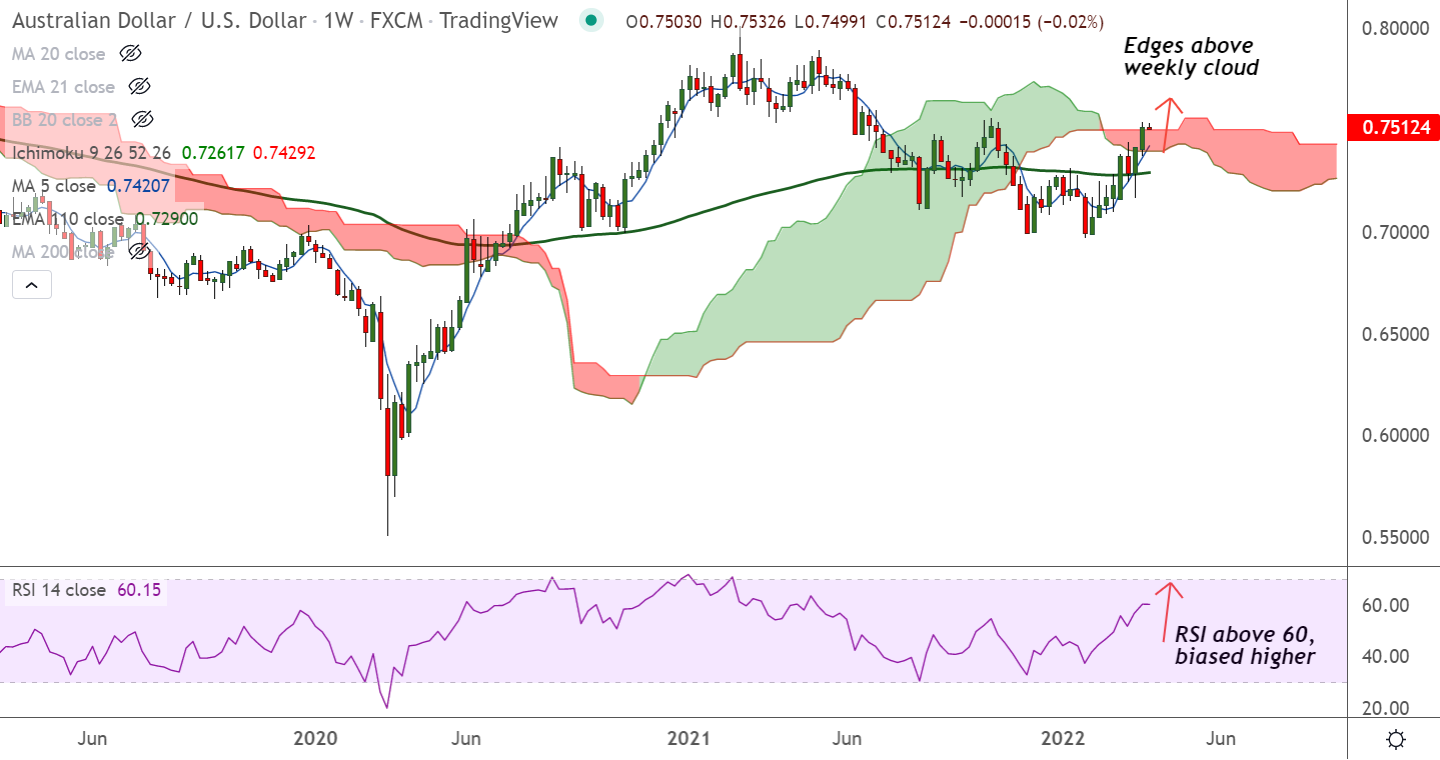

Chart - Courtesy Trading View

Spot Analysis:

AUD/USD has opened the week on a positive note. The major was trading 0.18% higher on the day at 0.7526 at around 05:35 GMT. Price action is in the green for the third straight week.

Technical Analysis:

GMMA Indicator - Major and minor trend are bullish

Ichimoku Analysis - Price action is above daily cloud and Chikou span is biased higher

Oscillators - Stochs and RSI are at overbought levels, but no signs of reversal seen

Bollinger Bands - Show volatility is high and rising

Major Moving Averages - Major moving averages are trending higher

Major Support Levels: 0.75 (Weekly cloud top), 0.7420 (5-week MA), 0.7413 (200H MA)

Major Resistance Levels: 0.7559 (Upper BB), 0.76, 0.7632 (110-month EMA)

Summary: AUD/USD is trading with a bullish bias. Price action has edged above the weekly cloud, raising scope for further gains. The pair is on track to test 110-month EMA at 0.7632.