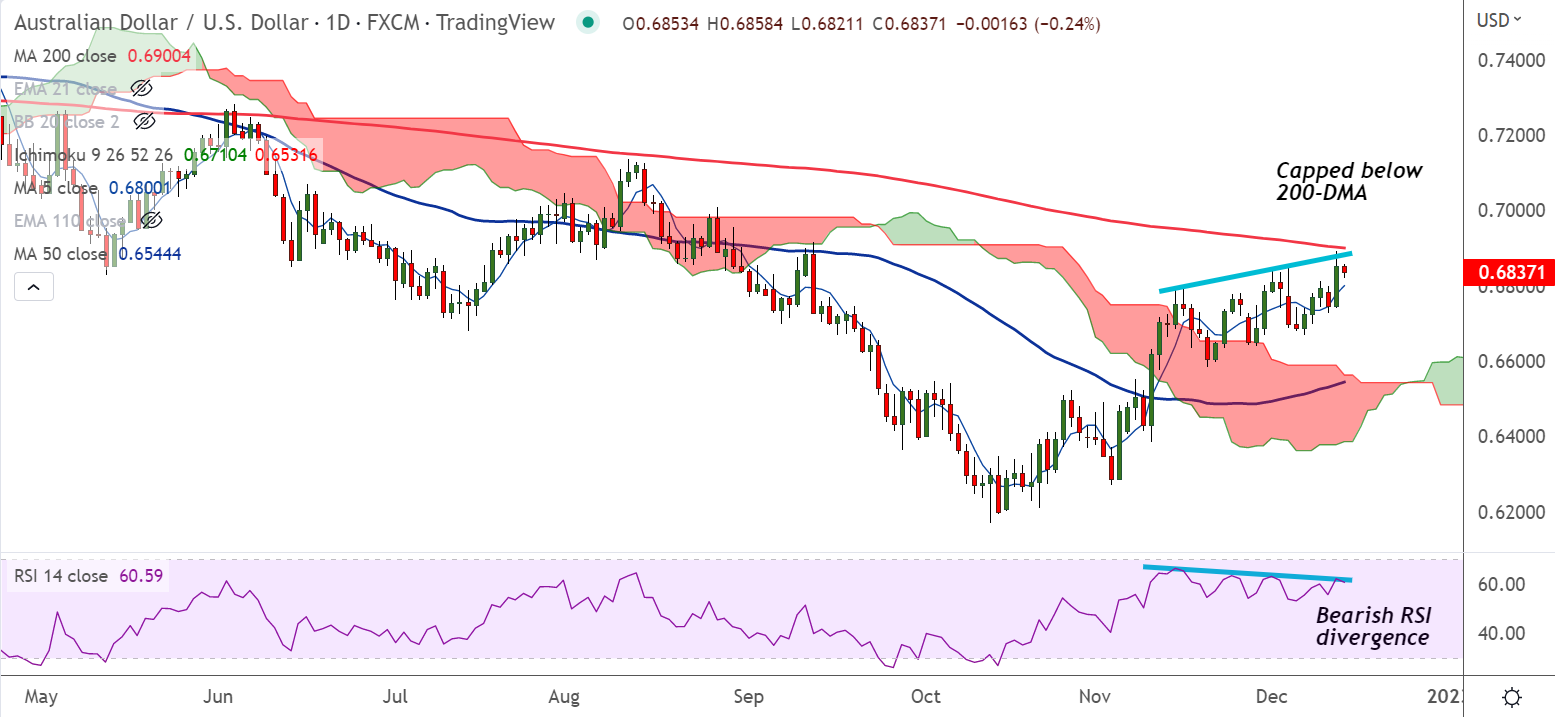

Chart - Courtesy Trading View

AUD/USD was trading 0.16% lower on the day at 0.6842 at around 05:45 GMT. The pair spiked higher on Tuesday after the releases of US CPI data, but upside remained capped below 200-DMA.

Market sentiment was somewhat lifted on Tuesday after data showed U.S. consumer price index (CPI) inflation eased more than expected in November, indicating that inflation has likely peaked.

US dollar gains were limited, USD crosses poped across the board as caution kicked in ahead of the Federal Reserve meeting on Wednesday.

Technical indicators for the pair show bullish bias for the pair. GMMA indicator show major and minor trend are bullish.

Price action is above cloud, MACD and ADX support upside in the pair. Momentum is bullish, volatility is high and rising.

The central bank is expected to raise interest rates by 50 basis points (bps). Traders will focus on the statement for clues on any potential changes to the Fed’s hawkish stance against inflation.

Major Support Levels:

S1: 0.6801 (5-DMA)

S2: 0.6735 (20-DMA)

Major Resistance Levels:

R1: 0.6867 (Upper BB)

R2: 0.6900 (200-DMA)

Summary: AUD/USD finds major resistance at 200-DMA. Technical indicators support gains. Watch out for decisive break above 200-DMA for further upside.