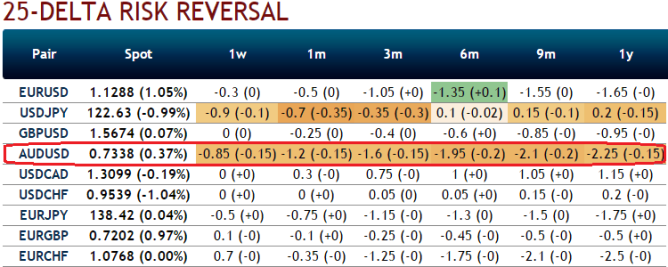

We continue to set up position with 2 lots of Out of the money puts on short side and simultaneously an in the money longs with slightly longer maturity. From the nutshell, 25-delta risk of reversals of AUDUSD the most expensive pair to be hedged for downside risks as it indicates puts have been over priced. As it showed the highest negative values indicate puts are more expensive than calls (downside protection is relatively more expensive). For the 6 months to 1 year time frame, delta risk reversal is getting closer to -2.

Delta for this strategy goes higher in magnitude but negative as the AUDUSD exchange rate persists to drop. Since the higher the underlying prices goes the less sensitive the option price becomes to underlying price changes, while gamma takes maximum value around out of the money strikes.

One should keep a close eye on the option premiums for each individual option he is buying - a small change in option premium values can make a big difference for this being a net debit or net credit position.

FxWirePro: AUD/USD PRBS as delta risk reversal indicates intensified bearish hedging

Monday, August 24, 2015 8:47 AM UTC

Editor's Picks

- Market Data

Most Popular