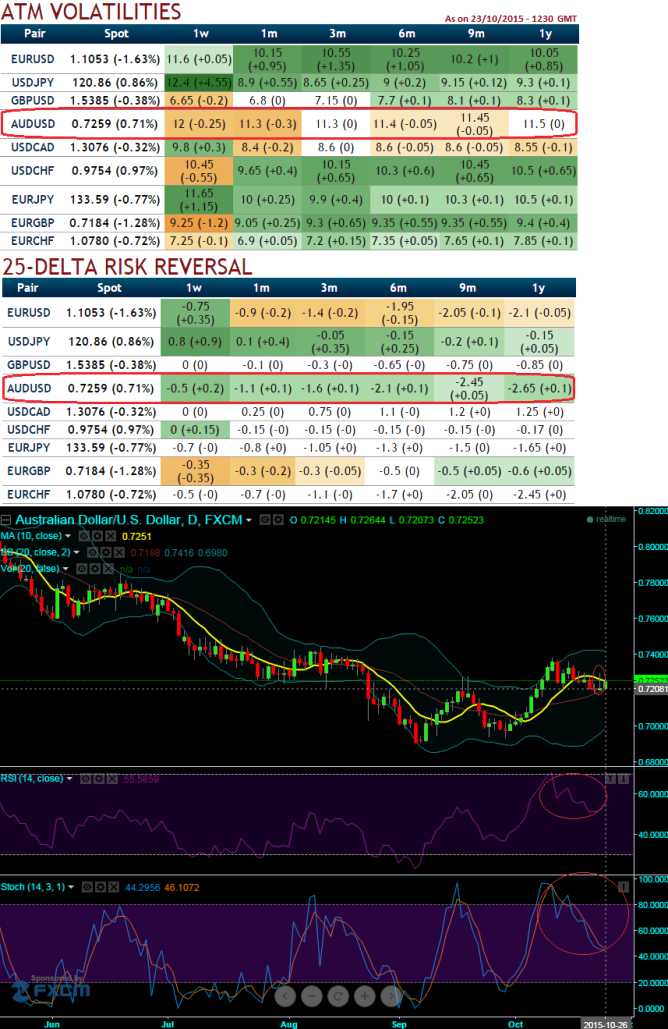

As you can observe from the diagram the implied volatility for near month at the money contracts of this APAC pair has been highest among G20 currency pool and is seen 12% levels for 1m expiry.

While delta risk reversal reveals where the FX market direction is heading towards, as a result downside hedging activity has been piling up.

The OTC options market appeared to be more balanced on the direction for the pair over the 1m to 1y time horizon and as a result delta risk reversal for AUDUSD has been maintaining negative which means puts are in higher demand and overpriced comparatively.

Hence, AUDUSD's higher IV with negative delta risk reversal can be interpreted as the market reckons the price has downside potential for large movement which is resulting derivatives instruments for downside risks have been overpriced.

Observe the circled area on technical chart, we spot out a shooting star pattern candle at around 0.7210.

Leading oscillators are to substantiate this bearish stance, the RSI (14) on daily chart has reached above 70 levels which is now signaling overbought pressure.

RSI's downwards convergence with massive price dips signifies bulls seem to be exhausted with their rallies.

While %D line crossover in overbought territory on slow stochastic curve is also evidencing clear selling pressures.

Overall, the major trend has been downtrend dominated by the bears with clear volume confirmation, we can only see next strong support at 0.7179 levels for this pair to bounce back.

FxWirePro: AUD/USD bearish sentiments mounting – head towards to test 0.7179

Monday, October 26, 2015 8:01 AM UTC

Editor's Picks

- Market Data

Most Popular