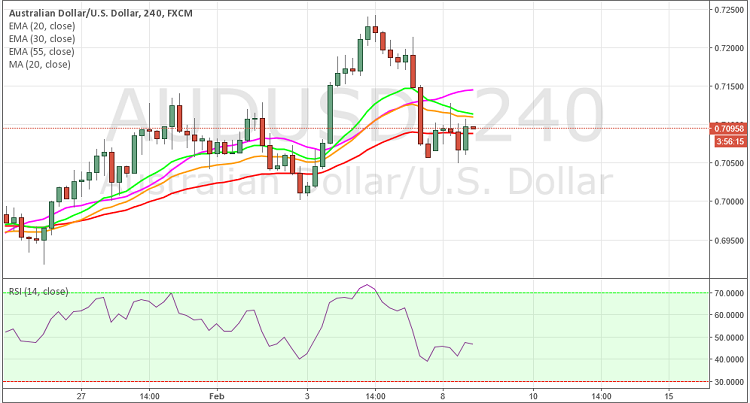

AUD/USD declined to trade in lower range on Monday as strong US wage data on Friday strengthened the green back against its Australian peer.

- Adding to the Aussie decline was also due to further fall in Crude oil prices, as no outcome came out of Saudi -Venezuela meeting to boost oil prices.

- Currently the pair is making an attempt to test support level at 0.9190.

- Further upside is expected to be limited as the pair finds strong resistance at 0.7000 which should limit upside and initiate bearish movement towards lower side.

- To the downside immediate support can be seen at 0.7000, a break below this level will open the door towards next level at 0.6960.

Recommendation: Go short around 0.7130, targets 0.7080, 0.7000, SL 0.7180

Resistance Levels

R1: 0.7108 (50% Retracement level)

R2: 0.7175 (61.8% Retracement level)

R3: 0.7242 (Feb 4th high)

Support Levels

S1: 0.7043 (38.2% Retracement level)

S2: 0.7000 (Psychological levels)

S3: 0.6960 (23.6% Retracement level)