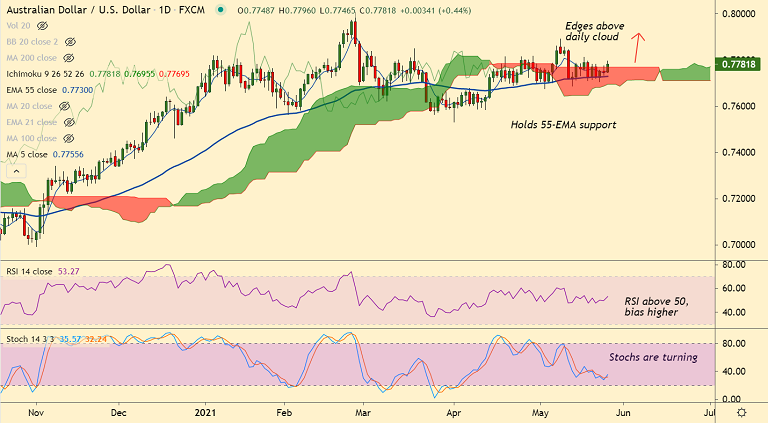

AUD/USD chart - Trading View

AUD/USD was trading 0.44% higher on the day at 0.7781 at around 10:35 GMT, slightly lower from session highs at 0.7796.

The Australian dollar was buoyed on upbeat economic data and rising commodity prices.

Data released earlier today showed the Australian Construction Output rose 2.4% in Q1, beating forecasts at 2.2%.

Meanwhile, the Westpac- Melbourne Institute Leading Economic Index grew at 0.2% in April, adding to the upbeat sentiment.

Further, rising commodity prices, which are an indication of a rebound in the economy, added to the optimism.

On the other side, U.S. dollar remains depressed as dovish Fed expectations keep the bulls from placing aggressive bets.

AUD/USD has been extending sideways along 55-EMA support. The pair is showing nascent signs of upside resumption.

Price action has edged above daily cloud and RSI has now turned north. Scope for test of 0.80 levels.