- AUD/USD rides the NFP wave, hit 3-week highs of 0.7368 before paring some gains to currently trade at 0.7330.

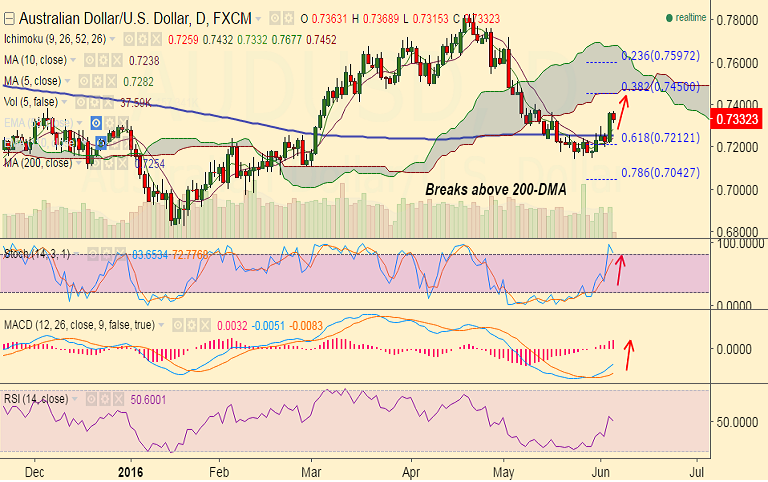

- The pair has broken above 200-DMA at 0.7254 and trades with a majorly bullish bias despite weak MI inflation forecasts.

- Data released earlier today showed Australia Melbourne Institute inflation reading came in at +1.0% y/y vs prior 1.5%. While m/m was at -0.2% vs +0.1% in the previous month.

- Data will be a concern for the RBA which meets tomorrow to decide policy.

- The RBA is widely expected to remain on hold considering the recent upbeat GDP data, while a dovish statement cannot be ruled out.

- Focus now remains on Fed Chair Yellen’s speech for fresh take on the US interest rates policy.

- Immediate resistance is 0.7368 (post NFP highs), break above can see upside till 0.74 and then 0.7450 (38.2% Fib).

- On the downside 200-DMA at 0.7254 is major support, break below invalidates bullish bias, exposes downside to 0.7148 levels.

Recommendation: Good to buy dips around 0.7320, SL: 0.7250, TP: 0.7368/ 0.74/0.7450