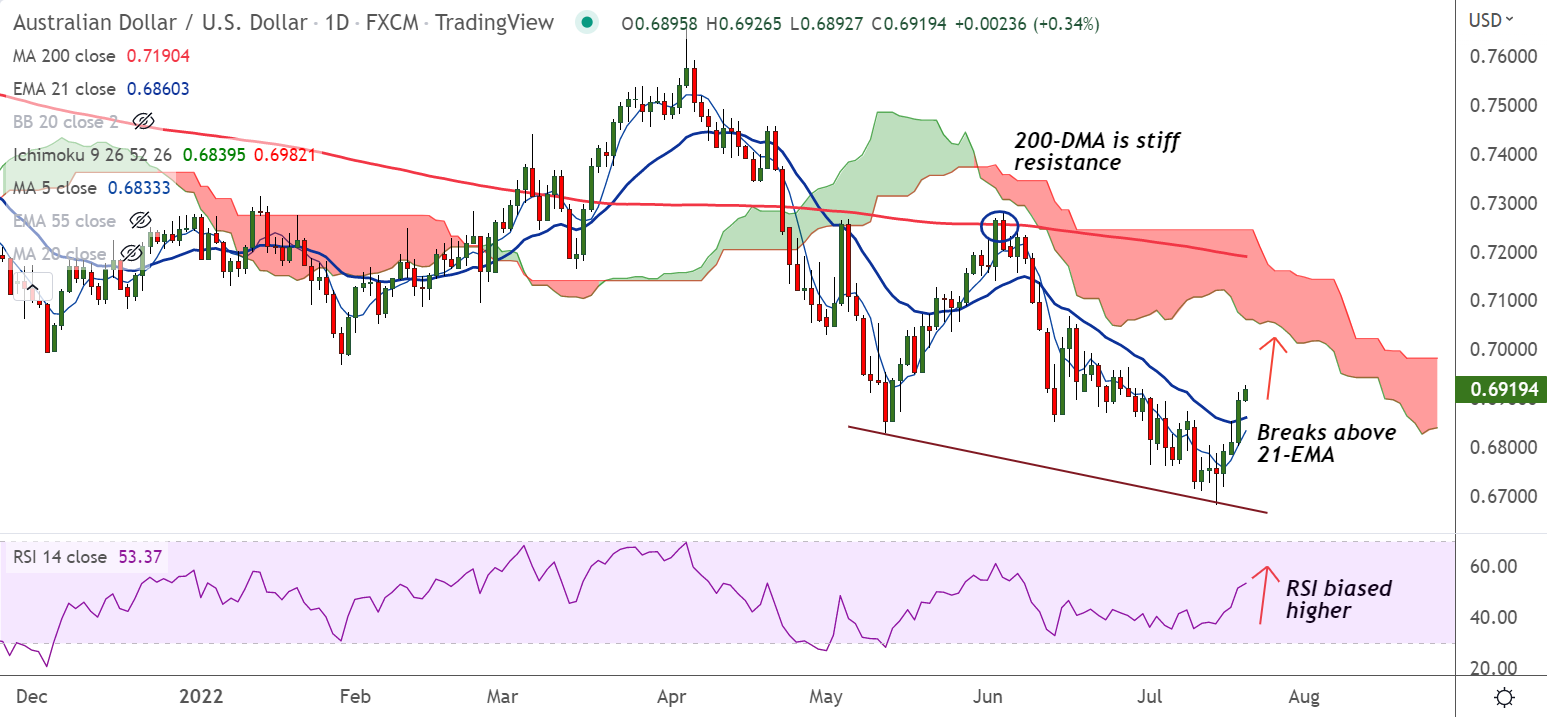

Chart - Courtesy Trading View

AUD/USD was trading 0.38% higher on the day at 0.6922 at around 04:55 GMT. The pair seems to find support after hawkish RBA minutes which showed the central bank sees more rate hikes over the months ahead. On the other side, DXY remains depressed for the fourth straight session, supporting the pair higher.

Technical Analysis:

- AUD/USD breaks above 21-EMA, hits highest for July till date

- Momentum is bullish, Stochs and RSI are biased higher

- MACD confirms bullish crossover on signal line

- GMMA indicator shows minor trend in the pair has turned bullish

Major Support Levels: 0.6860 (21-EMA), 0.6833 (5-DMA)

Major Resistance Levels: 0.6971 (55-EMA), 0.7075 (110-EMA)

Summary: AUD/USD technical indicators show scope for more upside. The pair is on track to test 55-EMA at 0.6971. Retrace below 21-EMA will negate any further bullishness.