- AUD/USD extends gains to hit fresh 3-week high at 0.7663 following the release of RBA’s quarterly Statement on Monetary Policy (SoMP).

- Aussie bulls cheered the RBA SoMP which provided no new surprises and no further easing bias.

- Uptick in copper prices alongside positive performance on the Asian equities, provide further support.

- US NFP data release due later in the US session is a major event risk, upbeat data could see downside in the pair.

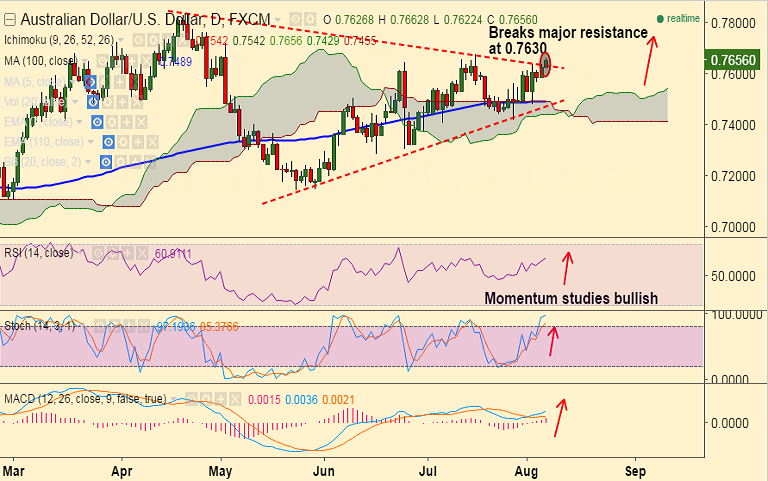

- Immediate resistance is seen at 0.7676 (July 15 high), 0.77 and then 0.7719 (May 3rd high).

- Supports on the downside are seen at 0.76 (5-DMA), 0.7556 (10-DMA) and then 0.7489 (100-DMA and cloud top).

- Techs support upside in the pair, momentum studies are bullish. However, Stochs are at oversold so possibility for correction.

Recommendation: Good to go long on dips around 0.7630, SL: 0.7580, TP: 0.7675/ 0.77/ 0.7720