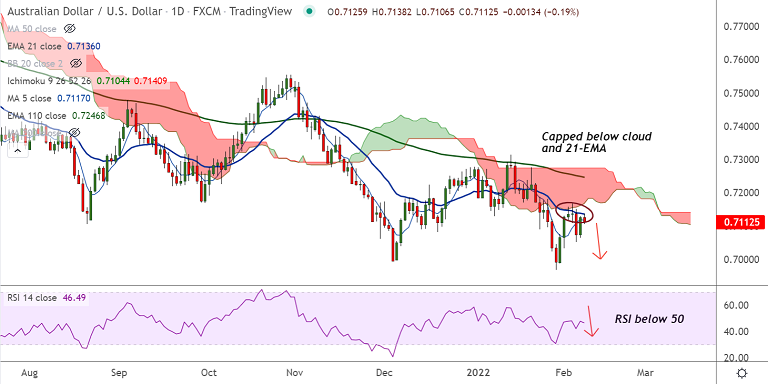

Chart - Courtesy Trading View

Spot Analysis:

AUD/USD was trading 0.15% lower on the day at 0.7114 at around 06:10 GMT.

Previous Week's High/ Low: 0.7168/ 0.6987

Previous Session's High/ Low: 0.7130/ 0.7065

Fundamental Overview:

Aussie bulls to remain in charge on RBA rate hike expectations. Australia's short-end yields hit the highest since 2019 before QE ends.

Fears of US trade sanctions on China, Russia-Ukraine tussles join fresh two-year high of US T-bond yields to favor bears.

Traders remain cautious amid mixed markets, Thursday’s US Consumer Price Index (CPI) will be of importance for further impetus.

Technical Analysis:

- AUD/USD struggles to extend previous session's gains

- Upside capped at 21-EMA resistance, 5-DMA is turning South

- 200-week MA offers stiff resistance for the pair at 0.7158

- GMMA indicator shows major and minor bias on the daily charts are bearish

Major Support and Resistance Levels:

Support - 0.7086 (200H MA), Resistance - 0.7136 (21-EMA)

Summary: AUD/USD recovery attempts capped at 21-EMA resistance, the pair is poised for downside resumption. Watch out for break below 200H MA for further weakness.