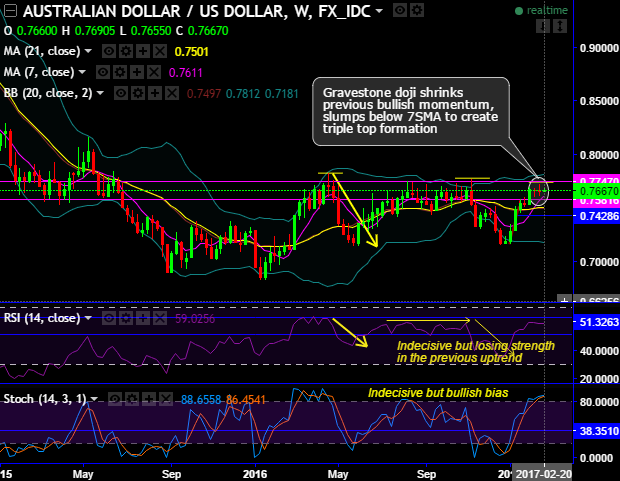

The pair forms double top with bearish patterns such as gravestone doji and shooting star candles at peaks (with top 1 at 0.7708 and top 2 at 0.7778 levels).

Gravestone Doji occurred again on last week’s candlestick pattern, the bearish pattern occurred at 0.7660 level that has indicated little weakness at the resistance of 0.7747 levels, but on the contrary, bulls have managed to bounce back sensing supports at 7 & 21SMAs (refer weekly), holding stronger at 21SMAs.

Although the bulls continue to carry previous month’s rallies, shrink in momentum is foresees at the stiff resistance of 57 levels on RSI, at this juncture, bull swings are hanging on channel resistance and 21EMAs again (refer monthly).

But, stochastic on the other hand, signals bullish momentum even though the other leading oscillator has been indecisive but losing strength in the previous uptrend.

As stated in our previous post, the major downtrend has been sliding through sloping channel but in the recent past it has gone into consolidation pattern (stuck in a range between 0.7874 levels on north & 0.7162 levels on south) but after testing support 0.7162 levels the prevailing upswings may prolong up to channel resistance (refer monthly plotting).

For now, previous month’s bullish engulfing pattern is boosting buying sentiments but the resistance of 0.7747 is closely watched whether bulls manage to breach decisively and sustain above or not.

Hence, considering intraday bear swings and recent consolidation phase, at spot reference: 0.7665 the speculators can eye on boundary binary options by using cash-or-nothing options for a range between 40-50 pips.

Upper strikes – 0.7690; lower strikes around 40 pips below 0.7650 levels.

The trading between these strikes likely to derive certain yields in this puzzling trend and more importantly these yields are exponential from spot FX.

For cash or nothing, these options would be exercised if the forward prices to remain between both strikes (i.e. 0.7690 > Fwd price > 0.7650).