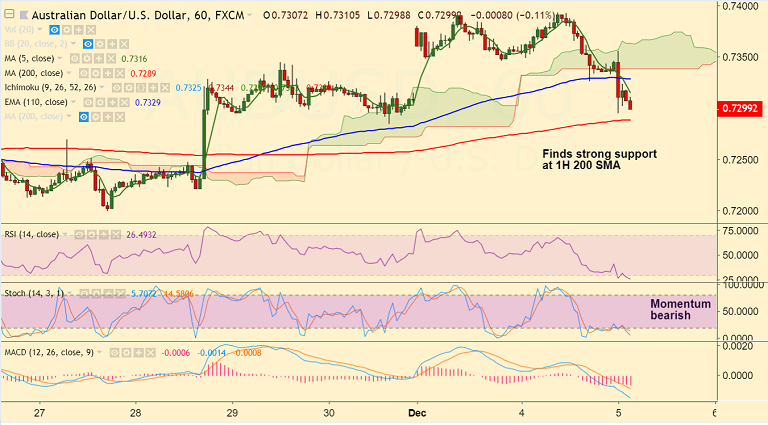

AUD/USD chart on Trading View used for analysis

- AUD/USD has resumed downside after a brief pause, bulls dented by dismal Australia Q3 GDP data.

- Australia September quarter GDP arrived well below estimates, supporting the view that RBA will keep rates unchanged through 2019.

- The pair edged slightly higher as a big beat on the Chinese Caixin November services PMI offered some reprieve to the Aussie bulls.

- China Caixin/Markit Nov Services PMI hit a 5-month high of 53.8 versus Oct’s 50.8 and beating estimates at 50.8, led by the rise in new orders.

- However, markets seems to have brushed aside upbeat China data and the major has resumed declie.

- We see strong support at 1H 200 SMA at 0.7289. Violation there could see further weakness.

- On the flipside, the pair has slipped below 5-DMA and retrace above could see gains upto 200-DMA.

Support levels - 0.7289 (1H 200-SMA), 0.7279 (110-EMA), 0.7266 (20-DMA)

Resistance levels - 0.7322 (5-DMA), 0.7363 (Upper BB), 0.7412 (200-DMA)

For details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

NZDJPY Bulls in Control: Buy-the-Dip Setup Points to 96 Target

NZDJPY Bulls in Control: Buy-the-Dip Setup Points to 96 Target  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  FxWirePro- Woodies Pivot(Major)

FxWirePro- Woodies Pivot(Major)