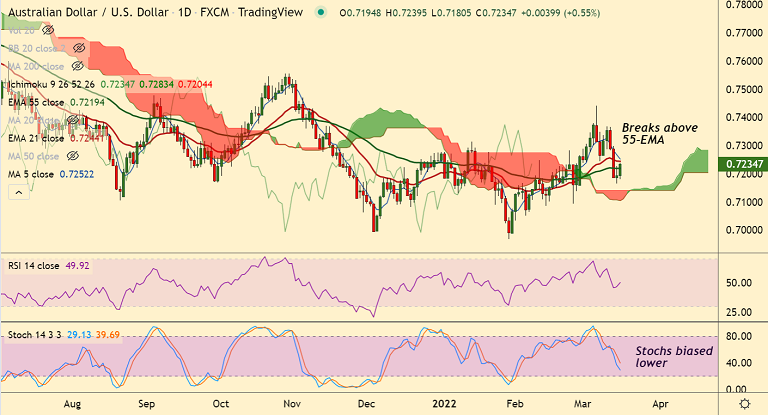

Chart - Courtesy Trading View

AUD/USD was trading 0.58% higher on the day at 0.7236 at around 10:25 GMT.

The pair is extending gains for the second straight session, breaks above 55-EMA.

Positive risk tone undermined the safe-haven US dollar and benefitted the perceived riskier aussie.

Further, reports that China will take measures to keep the stock market stable boosted investors' confidence.

Technical bias for the pair remains bearish as long as price holds below 200-DMA resistance.

The pair has bounced off with a Spinning Top formation in the previous session. Next immediate resistance lies at 0.7244 (converged 21 and 110 EMAs).

Concerns about a further escalation in the Russia-Ukraine conflict should keep a lid on gains.

Daily cloud offers strong support on the downside. Break below cloud will plummet prices.