- AUD/USD edges lower from session highs at 0.7695, trades 0.03% lower at 0.7676.

- Aussie weakens across the board after China PMI misses expectations, hits 4-month low.

- China's PMI came in at 51.0, missing 51.7 expected and compared to the previous period's reading of 51.6.

- Focus now on US NFP data, with US employment and wage growth figures hitting the markets on Friday.

- Technical indicators are slightly bearish, but bullish divergence on RSI and Stochs keeps scope for upside.

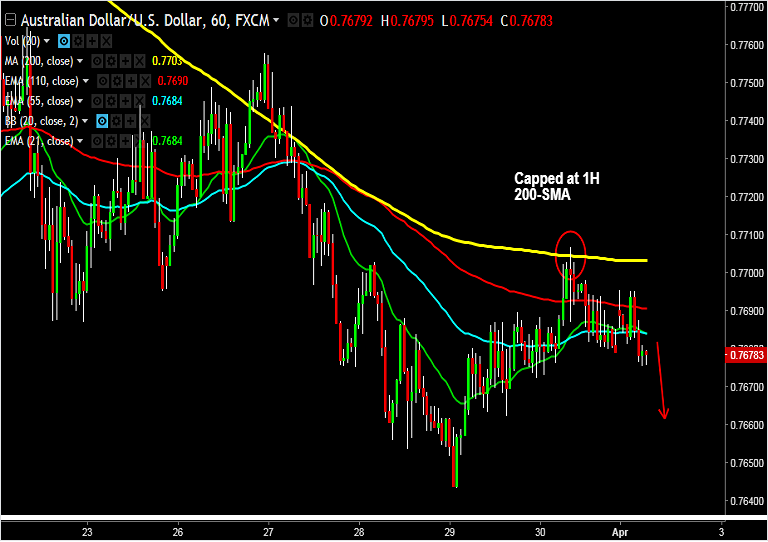

- Price action remains capped at 1H 200-SMA at 0.7703 and we see bearish invalidation on break above.

Support levels - 0.7637 (converged trendline & 78.6% Fib), 0.76, 0.7532 (Nov 21 low), 0.75

Resistance levels - 0.7674 (5-DMA), 0.77, 0.7743 (61.8% Fib)

Call update: Our previous call (https://www.econotimes.com/FxWirePro-AUD-USD-recovery-capped-at-077-handle-bias-lower-good-to-short-rallies-1225438) still active.

Recommendation: Hold for further weakness.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest