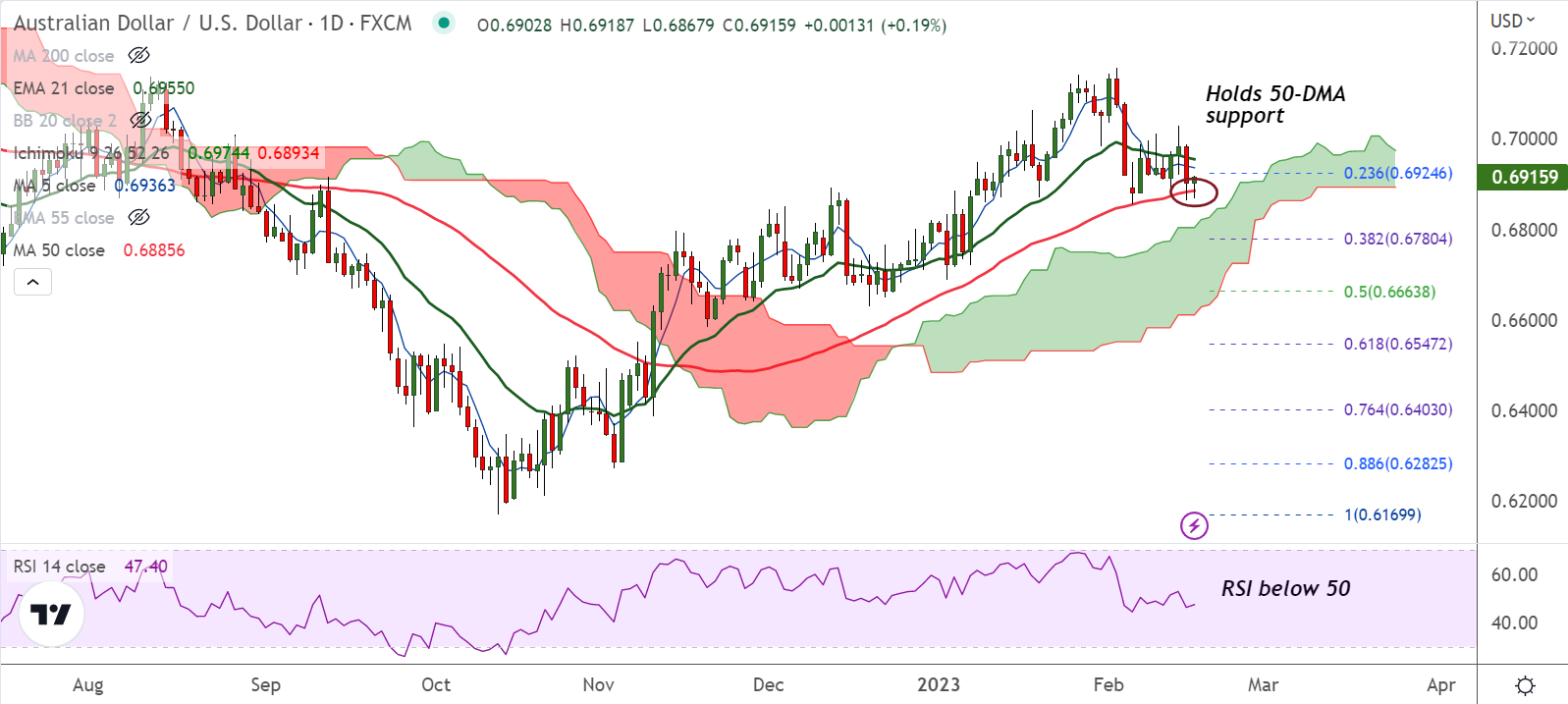

Chart - Courtesy Trading View

AUD/USD was trading 0.21% higher on the day at 0.6916 at around 04:45 GMT, up from session lows at 0.6867.

The major earlier plummeted after data released earlier on Thursday showed Australia’s job market unexpectedly cooled further in January.

Data released by the Australian Bureau of Statistics showed the number of employed people in the country fell 11,500 in January to 13.7 million, compared to expectations for growth of 20,000 people.

The unemployment rate was up to 3.7% from 3.5% in the prior month, its highest level since June. Australia’s participation rate fell to 66.5% in January from 66.6% in the prior month.

Earlier in the day, Australia’s Consumer Inflation Expectations for February also eased to 5.1% versus 5.6% market forecasts and previous readouts.

But weakness in the jobs market gives the RBA less economic headroom to keep raising interest rates.

On the other side, the US Dollar jumped to a six-week high amid strong US data in the previous day.

Data released on Wednesday showed US Retail Sales growth jumped to 3.0% YoY in January versus 1.8% expected and -1.1% prior. The Retail Sales ex-Autos grew by 2.3%, compared to analysts' estimate of +0.8%.

Further, NY Empire State Manufacturing Index for February improved to a three-month high of -5.8 versus -18.0 expected and -32.9 market forecasts. While, US Industrial Production came in at 0.0% MoM for January, missing estimates of 0.5% and -0.7% previous readings

Downbeat Australia employment and inflation data, the cautious comments from Reserve Bank of Australia (RBA) Governor Philip Lowe join the increasing market bets on the hawkish Fed moves to add downside pressure on the pair.

Major Support Levels:

S1: 0.6885 (50-DMA)

S2: 0.6804 (200-DMA)

Major Resistance Levels:

R1: 0.6955 (21-EMA)

R2: 0.6999 (20-DMA)

Summary: AUD/USD has bounced off 50-DMA support. Price action is below 200H MA, break below 50-DMA will see test of cloud support.