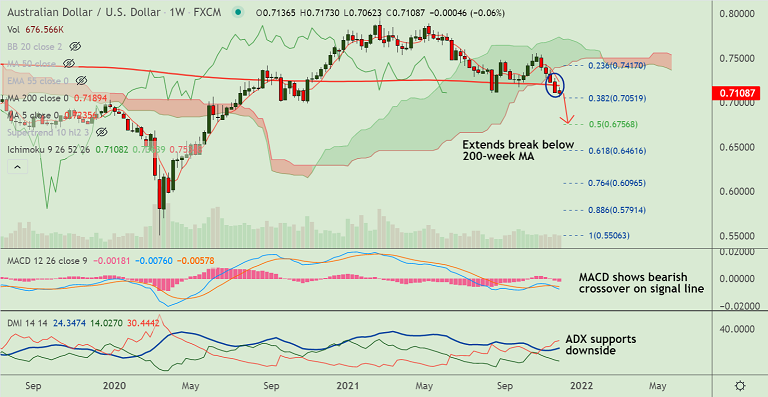

Chart - Courtesy Trading View

AUD/USD was trading 0.06% higher on the day at 0.7106 at around 07:30 GMT.

The pair has slipped lower from session highs at 0.7119, upside remains capped at 5-DMA.

Major trend in the pair is bearish, GMMA indicator shows strong bearish bias on the daily and weekly charts.

Price action is extending weakness below 200-week MA, MACD and ADX show downside support on the weekly charts.

Oscillators are at oversold levels, but no signs of reversal seen, scope for further downside.

Volatility is high and rising as evidenced by widening Bollinger bands. Scope for test of major trendline support at 0.7060.

Major Support Levels:

S1: 0.7060 (Trendline)

S2: 0.7051 (38.2% Fib)

Major Resistance Levels:

R1: 0.7117 (5-DMA)

R2: 0.7170 (200H MA)

Summary: AUD/USD is trading with a bearish bias. 38.2% Fib at 0.7051 in sight. Bearish invalidation only on retrace above 200-week MA.