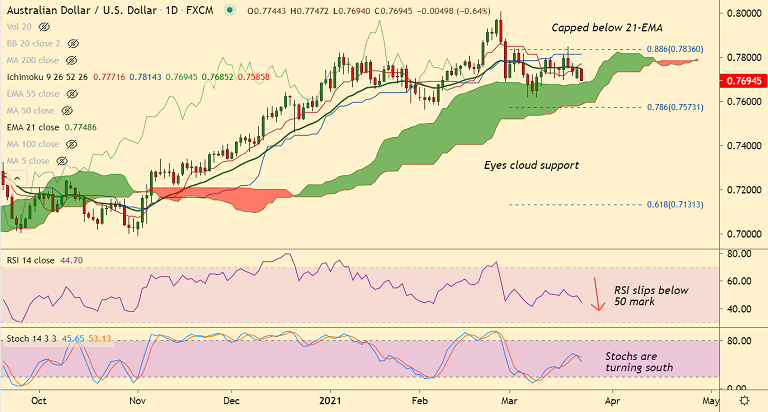

AUD/USD chart - Trading View

AUD/USD was trading 0.50% lower on the day at 0.7705 at around 04:40 GMT, outlook is turning bearish.

The major is extending choppy trade after being capped between 21 and 55 EMAs, breakout will provide clear directional bias.

Uptick in the US Treasury yields is driving the dollar higher adding downside pressure on the pair.

Caution prevails ahead of key US Congressional testimony by Federal Reserve Chairman Jerome Powell and Treasury Secretary Janet Yellen.

Geopolitical tensions between U.S. and China over Xinjiang human rights violation, also weigh on the sentiment keeping the antipodeans under pressure.

AUD/USD upside remains capped at 21-EMA. The pair finds strong support at daily cloud. Breach below will drag prices lower.

Scope for test of 110-EMA at 0.7572. On the flipside, immediate resistance at 21-EMA, break above will negate any bearishness.