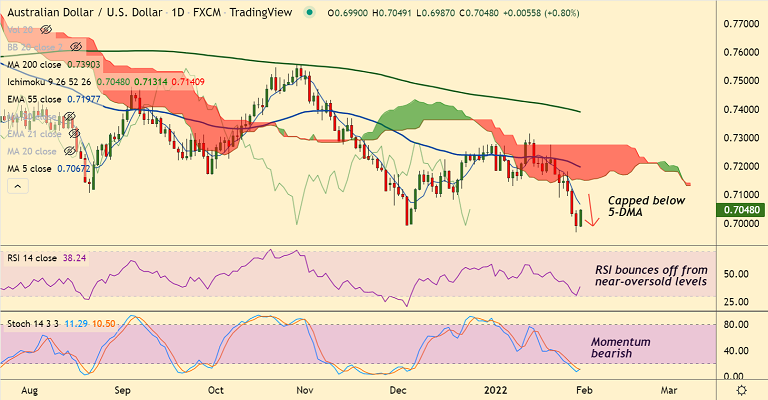

Chart - Courtesy Trading View

Spot Analysis:

AUD/USD was trading 0.69% higher on the day at 0.7040 at around 08:15 GMT.

Previous Week's High/ Low: 0.7187/ 0.6967

Previous Session's High/ Low: 0.7045/ 0.6967

Fundamental Overview:

Traders brace for RBA amid quiet session. Bulls await clues for the RBA rate hike during 2022.

US dollar’s weakness amid indecision over the pace of Fed’s rate hike in March keeps the pair supported.

On the data front, Australia’s December Private Sector Credit was up 0.8% MoM versus 0.5% forecast and 0.9% prior.

Technical Analysis:

- AUD/USD trades well below daily cloud and major moving averages

- Momentum is strongly bearish and volatility is high

- Price action is consolidating break below 200-week MA

- MACD and ADX support weakness in the pair

Major Support and Resistance Levels:

Support - 0.6950 (Lower W BB), Resistance - 0.7067 (5-DMA)

Summary: AUD/USD recovery lacks traction. Major trend remains bearish. Break above 5-DMA could see some upside. Breakout above daily cloud will change near-term dynamics.