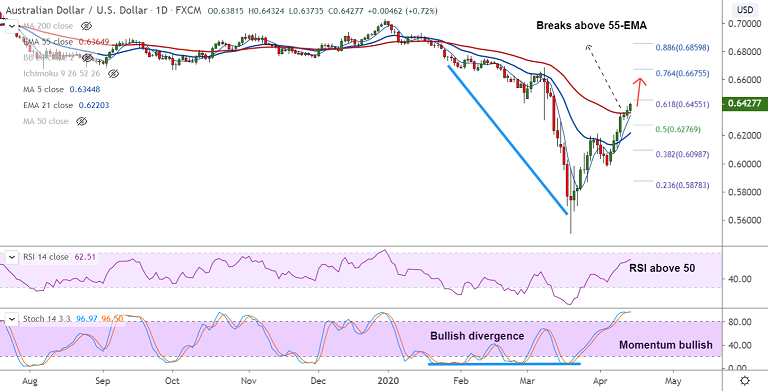

AUD/USD chart - Trading View

AUD/USD was trading 0.73% higher on the day at 0.6428 at around 02:00 GMT after closing 0.49% higher in the previous session.

Aussie shrugs off poor NAB Business Confidence data released earlier today, focus now is on China's trade data.

National Bank of Australia's (NAB) Business Confidence for March came in -66 at versus expectations for -2 and down significantly from February's -4.

The Business Conditions Index fell -21 in March versus expectations for 1 following February's reading of 0.

Technical bias for the pair remains bullish. Price action has broken above 55-EMA resistance.

Next hurdle for bulls aligns at 61.8% Fib at 0.6455. Further bullish momentum can see test of 110-EMA at 0.6533.

Major trend in the pair remains neutral as evidenced by GMMA indicator. Breakout at 200-DMA (0.6722) will shift major trend to bullish.

Major Support Levels: 0.6364 (55-EMA), 0.6343 (5-DMA), 0.6219 (21-EMA)

Major Resistance Levels: 0.6455 (61.8% Fib), 0.6522 (daily cloud), 0.6533 (110-EMA)

Summary: Break above 55-EMA has reinforced upside bias. Scope for gains till daily cloud. Focus on China trade data for impetus.

2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different