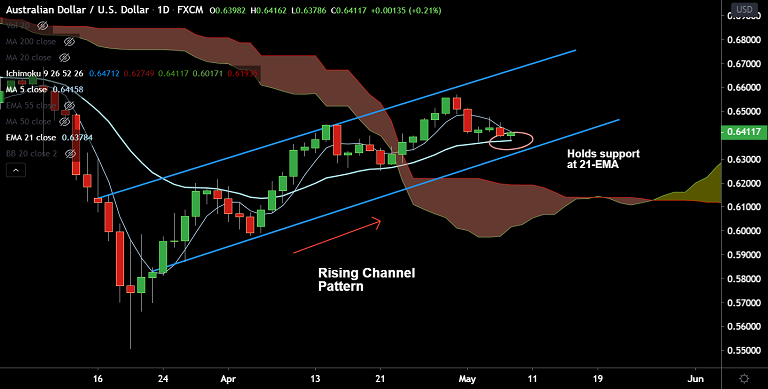

AUD/USD chart - Trading View

AUD/USD is extending marginal gains in the Asian session as Aussie benefits from better than forecast Australian Trade Balance.

Data released earlier today showed Australia’s March month Trade Balance printed at 10602M, a huge rise from the 3865M in the prior month and beating forecasts at 6800M.

Further details showed that Imports and Exports have slipped to 15.1% and -3.6% marks from 29% and 10% respectively in the prior month.

On the other side, the Australian dollar was largely unfazed by a big miss in Chinese Services PMI numbers.

China's Caixin services PMI for April came in 44.4 at vs. 51.0 expected and 43.0 last. Meanwhile, the Composite Output Index rose to 47.6 in April from 46.7 booked in the previous month.

Risk-off tone amid US-China tussle could limit upside in the pair. Intraday bias for the pair is neutral.

The pair is holding strong support at 21-EMA at 0.6378. Weakness only on break below.

Price action is extending in 'Rising Channel' pattern and holds above daily cloud. Resumption of upside will see next hurdle at 110-EMA at 0.65 ahead of 200-DMA at 0.6673.

On the economic data front, focus will be on China Trade data and U.S. Jobless Claims for impetus.

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch