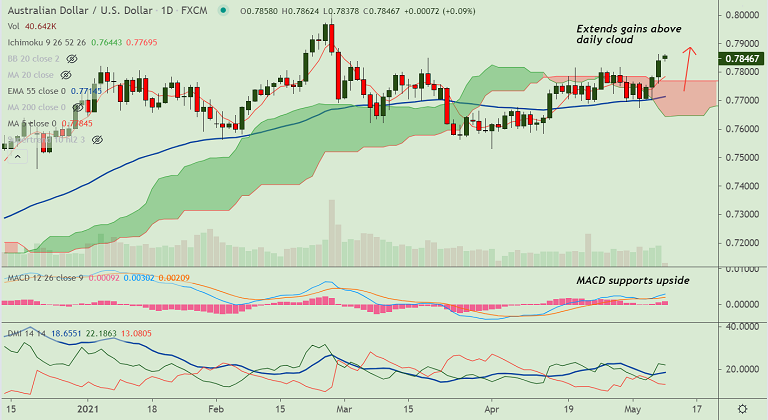

AUD/USD chart - Trading View

AUD/USD was trading 0.06% higher on the day at 0.7844 at around 04:30 GMT, extending previous session's rally.

The Australian dollar was buoyed as iron-ore prices surged past $220 mark to hit record highs amid a commodities supercycle.

The relentless rise in iron-ore prices comes on the back of China’s steel boom, with Chinese steel mills are scurrying for stockpiling Australian high-grade ore.

The rush to stock up iron-ore was the possibility of trade restrictions in light of China’s suspension of all activities relating to the Sino-Australia Strategic Economic Dialogue last week.

Weak U.S. dollar after dismal non-farm payrolls last week also adds to the pairs upside support.

Technical indicators are bullishly aligned and support gains. Price action is above cloud and major moving averages.

Major Support Levels:

S1: 0.78

S2: 0.7784 (5-DMA)

S3: 0.77 (110-month EMA)

Major Resistance Levels:

R1: 0.8066 (Upper M BB)

R2: 0.80

R3: 0.8262 (200-month MA)

Summary: AUD/USD is trading with a bullish bias. Price action has edged above monthly cloud raising scope for further upside. Next major bull target lies at 200-month MA at 0.8262. 5-DMA is immediate support at 0.7784. Bullish invalidation only below 0.77 handle.