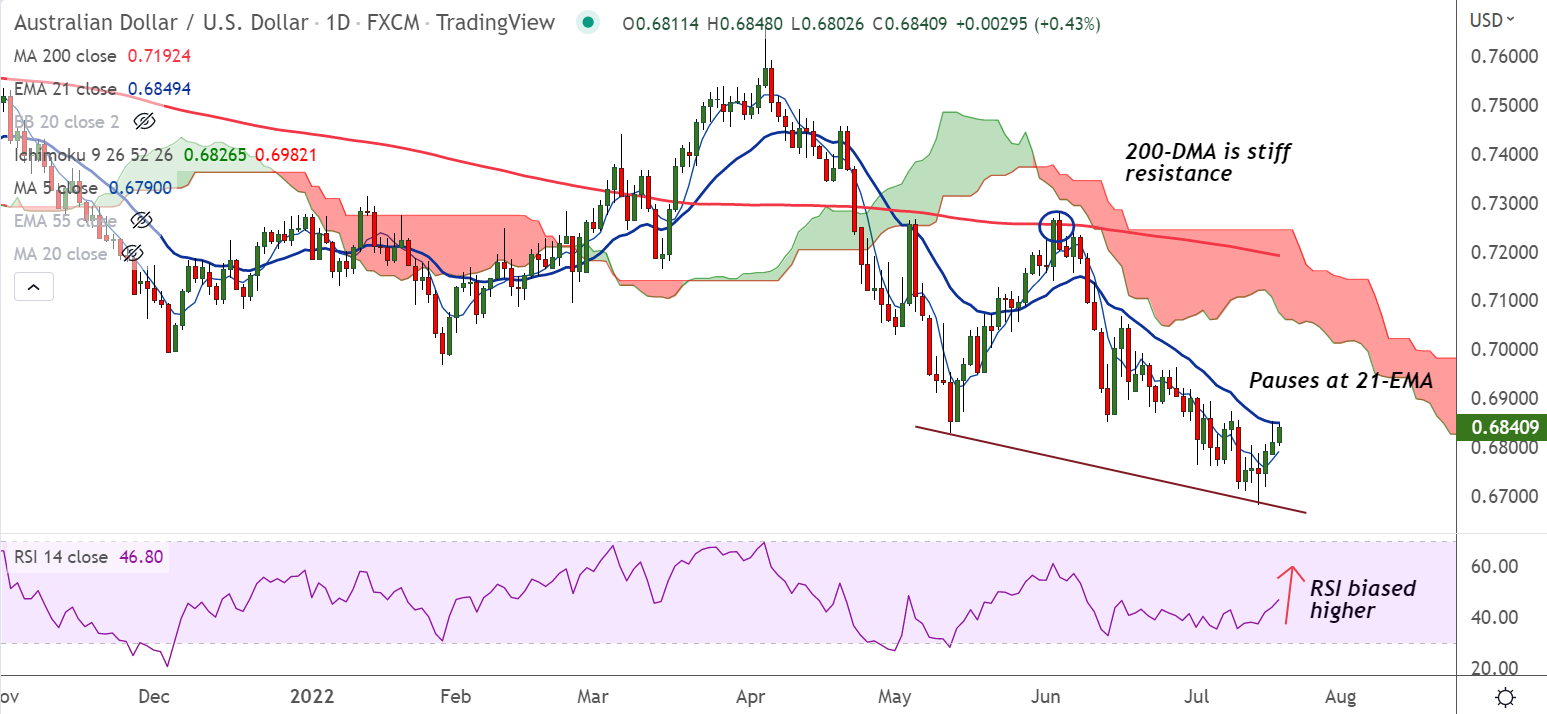

Chart - Courtesy Trading View

Technical Analysis:

- AUD/USD was trading 0.45% higher on the day at 0.6841 at around 05:10 GMT

- The pair is extending gains for the third straight session, hovers around 21-EMA

- Price action has edged above 200H MA and GMMA indicator shows bullish bias on the intraday charts

- 5-DMA has turned bullish, Stochs and RSI are biased higher, Chikou span is biased higher

- MACD confirms a bullish crossover on signal line

Fundamental Overview:

The Reserve Bank of Australia (RBA) has released July monetary policy minutes which show hawkish guidance by RBA policymakers, supporting the Australian dollar across the board.

The RBA elevated its Official Cash Rate (OCR) consecutively by 50 basis points (bps), which currently stands at 1.35%.

On the other side, the US dollar index (DXY) is likely to remain lackluster amid a light calendar week.

Major Support Levels: 0.6790 (5-DMA), 0.6786 (200H MA), 0.6710 (Lower BB)

Major Resistance Levels: 0.6849 (21-EMA), 0.69. 0.6971 (55-EMA)

Summary: AUD/USD pivotal at 21-EMA. Major trend remains bearish, but the pair is poised for further upside. Watch out for break above 21-EMA for more gains.